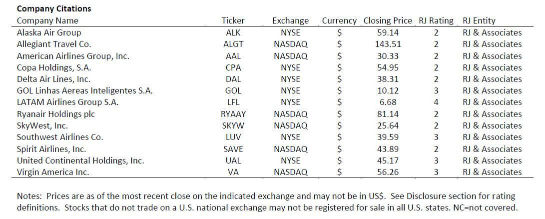

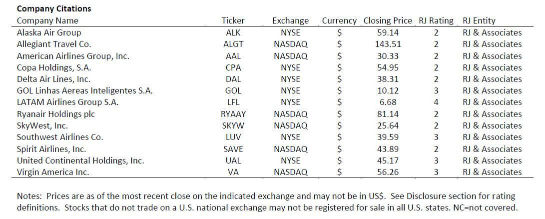

Raymond James and Associates Press Release | June 24, 2016

Estimated reading time 3 minutes, 43 seconds.

With the Brexit vote coming as a surprise, Raymond James and Associates expect airline shares to be under pressure in a “shoot first ask questions later” move in the market. Near-term earnings are unlikely to be substantially negatively impacted due to the forward sale of tickets and pressure on fuel prices.

However, fuel price pressure is a double-edged sword as it is likely to push out the unit revenue recovery needed for improving investor sentiment. Allegiant (ALGT), Spirit (SAVE), and SkyWest (SKYW), and to some extent Alaska (ALK) and Virgin America (VA), are likely best positioned until the ramifications of the vote are better understood.

Greatest exposure: Brexit comes as a surprise to the market and there is likely to be a rush to safety and away from cyclical stocks such as airlines. Among Raymond James and Associates’ coverage universe, Ryanair (RYAAY) and the U.S. Legacy airlines (AAL, DAL, UAL) are the most exposed. Also, the Latin American Airlines (CPA, GOL, LFL) are negatively exposed to potential strengthening of the U.S. dollar (USD).

Currency risk – beyond 2Q/3Q: The greatest near-term risk to earnings is from a stronger USD, primarily against sterling (GBP) and the euro (EUR). In addition to translation risk, and similar to last summer, transatlantic demand to the U.S. is likely to suffer (partially offset by increased demand from the U.S.) and domestic European travel is likely to be boosted. However, on both counts, the immediate impact is likely somewhat muted due to the forward sale of tickets, particularly in the peak leisure travel summer months.

U.K. exposure – not straightforward: Almost 40 per cent of Ryanair’s (RYAAY) seat capacity originates or terminates in the U.K., but it may benefit from a further shift from transatlantic to intra-Europe travel. American (AAL) and United (UAL) have the larger exposure to the U.K. among legacy airlines with five per cent and four per cent, respectively, of 2015 traffic (RPK) compared to two per cent at Delta. Additionally, American’s transatlantic partner, British Airways, is based in the U.K. However, this is largely the point of connection to Europe as opposed to an indication of greater point-of-sale concentration in the U.K. (much like Delta’s exposure to Paris is similar to United’s despite a larger capacity exposure). Of note, Europe (including U.K.) accounted for 16 per cent of Delta’s (DAL) 2015 traffic compared to 14 per cent at United (UAL) and 12 per cent at American (AAL).

U.S. leisure better positioned in the near term: The secondary risk is the impact to GDP from the corresponding uncertainty because airline earnings are heavily influenced by economic activity. On a relative basis, highly leisure- and U.S.-focused airlines such as Allegiant (ALGT) and Spirit (SAVE) are likely better positioned. Additionally, SkyWest’s (SKYW) largely cost-plus business model insulates much of its earnings (~80 per cent). Both ALK and VA are also somewhat better positioned due to greater leisure exposure and less reliance on transatlantic partner traffic.