WestJet’s 2015 jump in ancillary revenue has been attributed to the airline implementing a fee for the first checked bag, a policy that was enacted in the second half of 2014. Jan Jasinski Photo

The airline industry is characterized by low profit margins, significant price competition, a perishable product, and high capital and fixed costs. Revenues are sensitive to the actions of other carriers in many areas including pricing, sales promotions, scheduling, demand, market-specific capacity, market share per route, cost structure and ancillary revenue strategy, among others.

In many markets, legacy or major airlines compete with at least one low-cost carrier (LCC) including so-called ultra-low-cost carriers (ULCCs). These market disruptors are having a deep impact on industry revenues. Using the advantage of lower unit costs per mile associated with a number of core operational and financial efficiencies including but not limited to higher employee and assets productivity, leaner management and cost structures, faster aircraft turnaround times, secondary airport usage, high-density seating configurations and single (or not) aircraft type operation, they are able to offer lower fares than legacy carriers.

Consequently, they have been shifting demand from larger, more established legacy airlines and today, they are significant competitors, particularly for customers who fly infrequently and tend not to be loyal to any one particular airline brand.

Both LCCs and ULCCs focus their energies on price-sensitive travellers but ULCCs especially concentrate on offering the lowest possible airfares in order to stimulate a market while targeting new underserved potential segments, such as vying for passengers that are opting to switch from bus to air travel.

In the last decade or so, the global middle class population has expanded and more people are able to afford air travel. The ULCCs’ key growth strategy focuses on market stimulation through lower fares, thereby increasing load factors, and selling non-ticketed products and services (also known as ancillary revenue), which in turn facilitates even lower base (or “bare”) fares.

Nowadays, the new breed of ULCCs are financially stronger than ever, their order book continues to grow, they operate fuel-efficient and state-of-the-art aircraft and are expanding their networks to new markets.

This, among other factors, has put them in a unique position to better control costs per available seat mile (the average cost to fly an aircraft seat one mile), which in turn may enable them to even further lower bare fares. On the other hand, legacy carriers continue to lose important market share and revenue as they are unable to match ULCC bare fares, mostly due to higher costs, inefficient and even sometimes inflexible cost structures.

Interestingly, there are more developments in the ULCC/LCC and ancillary revenue world. A number of LCCs have transitioned to a hybrid model, where they are offering a less-dense seat configuration on their networks, with the goal of tapping into higher yield passenger segments such as business travellers.

These hybrid operations still keep many of the operational and cost structure efficiencies of a core LCC operation, but they are also introducing innovative products. JetBlue is one example, but the ancillary revenue strategy continues to be pushed to all of its network services.

This business model evolution is bad news for cost inflexible legacy carriers. They can’t compete in the visiting friends and relatives segment with ULCCs/LCCs, but now hybrid/LCC airlines are also targeting legacy airlines’ bread and butter traffic—the high-yield business class segment.

But does this spell the end for legacy carriers in price-sensitive segments such as leisure and visiting friends and relatives travel? Not necessarily, as recent market developments have shown.

One strategy is to launch a new branded service to compete head-to-head with lower cost competitors. Air Canada Rouge is one example where a new leisure brand was introduced to match leisure competitors’ unit costs. In Europe, Eurowings is another example.

Another strategy is to unbundle items that used to be free, such as checked bags, in order to lower base fares and allow price-sensitive passengers to choose à la carte products and services at an additional fee.

Ancillary revenue is a multi-billion dollar industry and an important airline revenue enhancer that is allowing carriers to boost airline profits. Moreover, it has also enhanced (especially for price-sensitive passengers) the overall customer travel experience through added value products and services to which they might respond positively.

In addition, it has opened the doors to industry modernization by incorporating a number of merchandising and retailing tactics, including how best to promote a product; going beyond the traditional purpose of trip segmentation to a target marketing level; detailed customer analytics; lifetime customer revenue stream analyses; and building customer preference databases.

Furthermore, it promotes the understanding of buying behaviour and patterns, up-selling and cross-selling high margin offerings, customer acquisition and retention costs and even cabin class ancillary sales achieved per square foot or mile for those airlines that operate a premium seating class product, among others.

Finally, a number of airlines are distributing tailor-made ancillary sale messages at various points before a flight—10 days to 24 hours before departure—as well as during and after flights, using geo location technology.

Continuing within an ancillary revenue environment and in order to optimize revenues, airlines are putting together specific fare types with a number of defined ancillary revenue perks, or so-called branded fares that could include priority screening, advance boarding, a no-change or cancellation fee, first access to overhead luggage bins and complimentary food and beverages, among others.

Furthermore and typically segmented by purpose of travel, a number of airlines are using dynamic bundle packages to derive premium revenue. For example, an Executive bundle might include a no-change fee plus Wi-Fi, priority boarding, a premium seat and a power port.

A comfort bundle could include a pillow, a blanket, a window seat and a noise cancelling headset. A bundle for a pregnant mother might include a free extra bag, a no-change fee, expedited airport check-in, priority security line access and priority boarding.

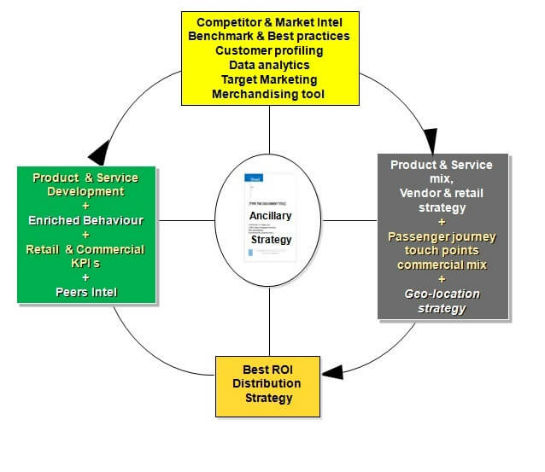

But what are the key elements of a successful ancillary revenue strategy? Figure 1 below shows a number of them:

Figure 1.

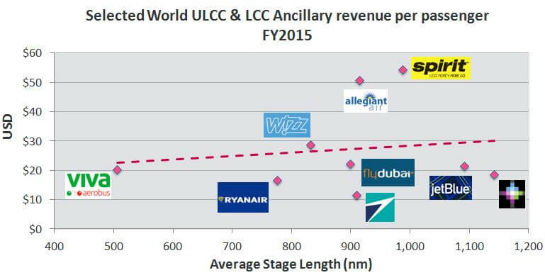

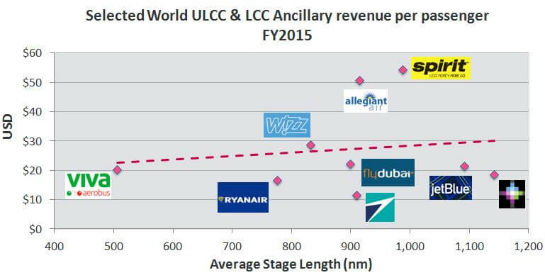

Benchmarking is also a key component of a robust ancillary revenue strategy, as it allows comparing an airline or a group of airlines while observing relative efficiencies and ratios. Average stage length is a better (if not the best) indicator than fleet size or some other parameters when comparing (in this case) ancillary revenues.

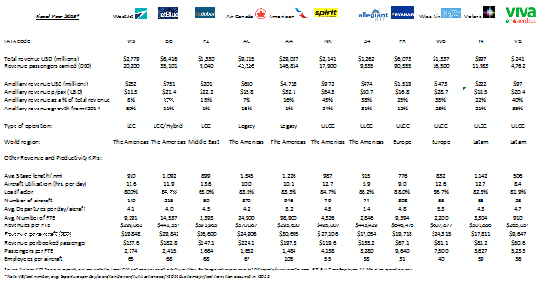

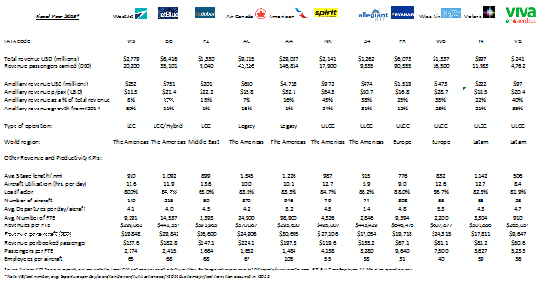

The table below (Figure 2) focuses on three peer-to-peer segment analyses as follows: WestJet and JetBlue in the LCC and hybrid/LCC segment; Air Canada and American Airlines in the legacy carrier segment; and ultimately a number of comparable stage length carriers in the ULCC segment.

Figure 2.

Figure 3.

Key conclusions from this ancillary revenue and productivity benchmark exercise are:

1. In the LCC and hybrid/LCC segment, Figure 2 shows WestJet ancillary revenue per passenger is lower than its peer, JetBlue. In fact, JetBlue generates three times as much ancillary revenue. JetBlue’s largest ancillary product remains the EvenMore space seat purchase, generating $228 million in revenue or 30 per cent of total ancillary revenue, in 2015.

However, WestJet ancillary revenue has been making significant progress. In 2015, its big ancillary revenue jump is attributed to one of the top three ancillary revenue generators—first checked baggage fees, which were implemented by WestJet and Air Canada in the second half of 2014.

My assumption is that WestJet might potentially evolve and migrate toward a hybrid/LCC model in the future with a similar premium product (as JetBlue has) with its Boeing 767-300 long haul operation. On the other hand, flydubai has the highest aircraft utilization per day of benchmarked peers and the lowest load factor but is able to turn over the highest ancillary revenue per passenger in this group, as shown in Figure 3.

2. In the legacy carrier segment, Figure 2 shows Air Canada ancillary revenue per passenger is below its peer. In fact, American Airlines doubles Air Canada in terms of ancillary revenues per passenger.

3. In the ULCC segment, Figure 3 shows Spirit Airlines and Allegiant Air ancillary revenue per passenger outperforming its peer group. In fact, Figure 2 shows that Spirit Airlines derives an impressive 45 per cent of its total revenue from non-ticket sales. On a per-passenger basis, this represents US$54.3, the highest when compared to its peers. Interestingly, Allegiant Air has the lowest number of departures per day but manages to be a top performer as well. Its ancillary third party revenue margin exceeds 30 per cent, and 95 per cent of its sales come from its website, which is not only the least expensive sales channel but also the preferred one from a branding and customer relationship standpoint. Moreover, Figure 3 shows VivaAerobus and Wizz Air are strong performers as well and are positioned at the ancillary revenue trend exhibited by their ULCC peers. They derive 40 per cent and 35 per cent, respectively, of their total revenue from ancillary revenues. In addition, Ryanair has the highest load factor number among its peers which puts it in a strong position to increase ancillary revenue per passenger and further optimize margins.

To conclude, ULCCs are an important customer option. It is expected they will continue penetrating and stimulating new underserved markets, allowing them to increase load factors and ultimately sell more ancillary revenue products and services, which in turn should further push ticket prices down.

Therefore, it is expected that more carriers under a LCC or ULCC business model, combined with a robust ancillary revenue foundation, might step up, leaving it to legacy airlines to continue transforming their businesses. This will include fine-tuning an effective ancillary revenue strategy that allows them to stay bare fare competitive in order to remain a viable and sustainable business model, at least in the price sensitive market segments.

René Armas Maes is director of sales and marketing at First Air, The Airline of the North.