Estimated reading time 15 minutes, 25 seconds.

Jack be nimble, Jack be quick. Sage advice for emergent ultra-low-cost carriers (ULCCs) seeking to avoid cash burns and resultant losses in this new and rapidly growing segment of the aviation marketplace. The increasing demand for low-cost air travel has spawned a new generation of air travel options, along with a shift in business models in the Canadian domestic aviation market.

These new travel options have made for a complicated mix of fares and offerings. First class, economy, premium economy, no frills, discount, low-cost, ultra-low-cost, unbundled fares… The list seems to go on and on.

This article’s focus is on current Canadian ULCCs — Flair Airlines, Swoop, and Lynx Air — starting with a bit of background on the structure of the commercial aviation sector.

Mixed Models

It’s not an easy job to manage a new enterprise, but the airline sector is especially challenging given the competitive nature of ticket pricing, customer service, flight schedules, destinations served, and fuel price volatility — as well as a long list of external factors such as weather, the economy, and changes in regulatory structures. The last two years have been especially difficult times for air carriers amidst the global pandemic.

However, the industry seems to be gaining some measure of stability through an emerging structure of three different business models that have come through the smoke and debris of a beleaguered industry. These include full-service carriers (sometimes referred to as network carriers); low-cost carriers (LCCs); and the previously mentioned ULCCs.

Full-service carriers operate hub-and-spoke networks, having a major airport such as Chicago O’Hare or Toronto Pearson serving as transfer points to smaller locations. They typically operate multiple aircraft types over short- and long-haul routes, with different fare classes and often frills like free comfort amenities, in-flight entertainment systems, and frequent flyer programs, all making for a higher-class (and more expensive) product overall.

LCCs — also called low-cost or budget airlines — offer lower ticket prices at the get go compared to full-service airlines, but they’ve removed some of those in-flight frills that create added costs, and typically only offer one class of service. Such carriers do not cater towards passenger comfort the way that full-service carriers do.

ULCCs, pioneered in Europe by Ryanair and in the U.S. by Spirit Airlines, do not offer any frills in the overall ticket price offered by LCCs. The target market: passengers who want to reach their destination at the least possible cost. What they get is a seat on a plane, with additional fees for a carry-on bag, checked baggage, seat selection, in-flight beverages (which can even include water), etc.

The foundation of the ULCC business model is to have lower overall costs than traditional LCCs. This directly results in lower ticket prices, but the key here is in how those lower overall costs are achieved — especially given the reduction in revenue per seat mile that lower ticket prices bring. The answer lies in prudent scrutiny of destination and route selection, operating fuel-efficient aircraft, eliminating frills and, in general, keeping a sharp pencil on the expense column in the accounting ledger.

How the ULCCs will ultimately change the Canadian airline marketplace is still up for grabs. Will they fit the role as disruptors? How intense will the competition become in that segment? How will legacy players respond and adapt?

Into this fray enter Flair, Swoop, and Lynx.

Flair

Flair began operations in 2005 with a single Boeing 727-200 out of Kelowna, British Columbia, targeting charter work and aircraft, crew, maintenance, and insurance services for other airlines. During the first decade of the new century, work expanded slowly, and the carrier added 737-400s to its fleet.

In 2017, Flair entered the ULCC market with the purchase of Winnipeg-based NewLeaf Travel Company, and grew its 737-400 fleet. The following year, the carrier added three Boeing 737-800s to modernize its fleet, and moved its head office to Edmonton.

Miami-based 777 Partners LLC took a 25 percent interest in Flair in 2019 – just before the Covid-19 virus emerged and devastated the air travel industry. As a result of the global pandemic, Flair’s fleet was reduced to just three 737-800s.

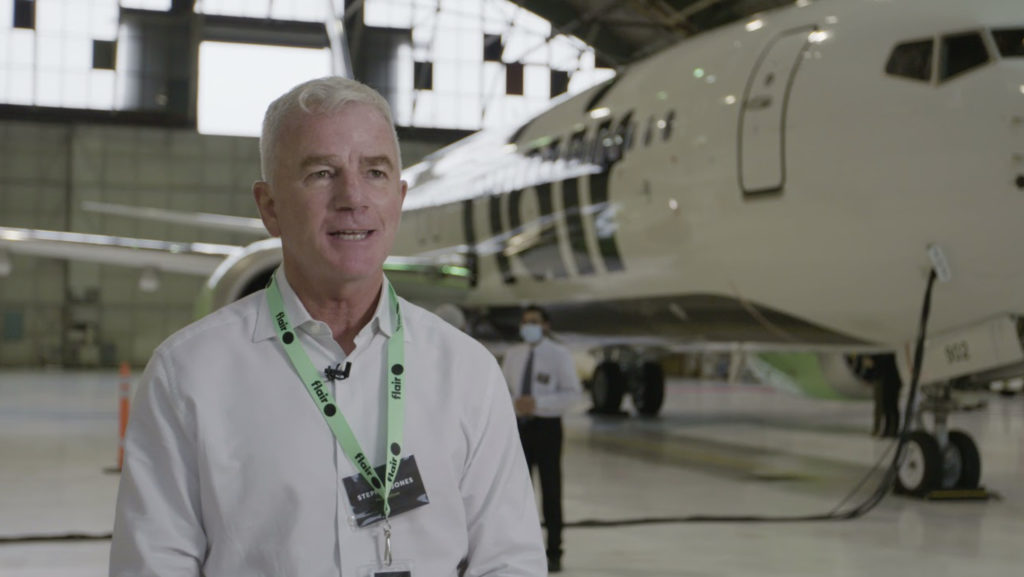

Enter Stephen Jones, who became Flair’s new president and CEO in October 2020. Jones came to Flair after serving years as Deputy CEO at the European ULCC, Wizz Air. With a new leader came major changes for Flair in early 2021, when the airline announced it would be leasing 13 new Boeing 737 Max 8s from 777 Partners, and that it would be serving 20 Canadian destinations by mid-summer, adding U.S. destinations later in the year.

In June 2021, Jones highlighted the airline’s “F50” goal, “to get to 50 aircraft within five years,” he said.

Then, in December 2021, the carrier announced its intention to lease 14 737 Max 8 aircraft, in addition to the 13 Max 8s that it ordered earlier in the year.

By the end of 2021, Flair had a total of 12 aircraft in service (nine Max 8s and three 737-800s), and was aiming to bring another eight Max 8 aircraft online in the first half of 2022.

While the airline is fast-tracking its fleet growth, it has also grown to serve 40 cities across Canada, the U.S., and Mexico.

As far as the competition in the market goes, Jones believes the airline can remain competitive “by having our costs as low as possible, and the 737 Max is a fantastic platform for that” — since the type is approximately eight percent less expensive than a similarly configured 737-800.

“But in every other piece of our business model, we really focus on the costs,” continued Jones. “By keeping our costs under control . . . then we can offer low fares into the market.”

In August 2021, Flair CFO Joe Lee expanded on that strategy when he told Skies that “new planes with maximum fuel efficiency, a relentless process of evaluating suppliers, fast turn times at airports, and low airfares that enhance load factors will all contribute to keeping costs low.”

Up to this point, it was like the ULCC seemed on a roll. But things took a turn in early March 2022, when the Canadian Transportation Agency (CTA) issued a preliminary determination that Flair Airlines may have violated foreign ownership rules as per the Canada Transportation Act. The concerns relate specifically to Flair’s investor and aircraft lessor, 777 Partners.

On May 3, Flair submitted a formal response to the CTA. A month later, on June 1, the CTA determined that Flair had addressed the concerns raised by the agency in its March preliminary review, and that the airline is, indeed, Canadian. Find more details on that story here.

Swoop

A ULCC owned by the WestJet Group, Swoop’s operations launched in June 2018 with just two aircraft. As part of its business model, Swoop’s base fares are 40 percent lower than its parent company. The carrier has described itself as “unbundled,” meaning customers purchase a seat and then create the travel experience around them.

In just under four years, Swoop has grown its fleet to 10 Boeing 737-800 NG aircraft, and recently announced it is adding six 737 Max 8s to its fleet — all of which the airline expects to receive by the summer. The carrier is also expanding its domestic network, and will be serving 11 U.S. destinations this summer from its three main Canadian bases in Toronto, Hamilton, and Edmonton.

In a February statement, Swoop’s head of commercial and finance, Bert van der Stege, said the carrier’s decision to purchase additional aircraft and expand its network was based on anticipated demand for travel this summer, following substantial demand over the 2021 holiday season.

The network expansion will increase the ULCC’s non-stop domestic routes to 37 as of summer 2022, with added coverage throughout Atlantic Canada.

“We know how important the re-opening of travel and tourism is for regional economic recovery, and we will continue to call on the federal government to outline a roadmap for the recovery of air travel that is based on science and reflective of the current realities of the Covid-19 pandemic,” said van der Stege.

Recently, Swoop has continued aggressive expansion of its fleet and destinations. In the first quarter of 2022 alone, flights were introduced to Kelowna, Charlottetown, Ottawa, New York, Chicago, and other major U.S. airports. In addition to these major changes to operations, Bob Cummings returned to the WestJet Group in April 2022 as Swoop’s president.

“Swoop was created to make travel affordable and accessible for the most price-conscious travelers, and as we continue to expand and offer more schedule options, people can book with confidence when choosing our Canadian, ultra-low-cost airline,” said Cummings. “I am elated to return to the WestJet Group’s leadership team and am looking forward to working alongside Swoopsters to bring more choice, lower fares, and certainty to the market.”

Lynx

Lynx Air was introduced as Canada’s newest ULCC on Nov. 16, 2021, during a press conference held at Calgary International Airport, with plans to offer “low fares, flexibility, and choice.” To meet projected demand, president and CEO Merren McArthur said the airline had commitments in place for 46 Boeing 737 Max aircraft over the next seven years, and that the airline is expected to create roughly 450 jobs over the next 12 months.

Lynx Air was previously known as Enerjet — a charter airline company that worked primarily with oil sands businesses. Enerjet officially launched in 2008, and over a decade later in 2021, it rebranded as Lynx Air.

“We are adopting the ULCC model, which has been successful in Europe and the United States for some time now, but which has not really taken off here in Canada,” McArthur told Skies. “In Europe, over 40 percent of all airline seats are offered by ultra-low-cost carriers, yet in Canada it is only about 12 percent — and on some routes it is as low as three percent. We see that as a huge opportunity.”

McArthur, previously CEO of Tigerair Australia, Virgin Australia Regional Airlines, and founding CEO of Virgin Australia Cargo, comes with a wealth of aviation experience, specifically in the ultra-low-cost market.

In terms of the airline’s fares and service options, Lynx Air is taking a somewhat unique approach. McArthur explained that Lynx has “developed a transparent, a la carte pricing structure, which enables passengers to pick and pay for what they want and nothing more; they can save on the journey and spend more where it counts — at the destination.

“In fact, we won’t even be offering food or entertainment on board,” continued McArthur. “If you think about it, you’ll get better value and better choice if you ‘bring your own,’ and we will be encouraging our passengers to do just that. It is all about transparency — people know what to expect when they come on board a Lynx aircraft.”

Currently, Lynx serves 10 cities across Canada, with expansion to new destinations to be announced throughout 2022.

The carrier flew its inaugural flight on April 7, 2022, from Calgary to Vancouver, and has been ramping up service ever since. Lynx currently has three 737 Max aircraft in its fleet, and is expecting to add another two aircraft heading into the busy summer season.

While Lynx is the third carrier to enter the ULCC segment in Canada, McArthur is not worried about competing for market share.

“Airfares have been too high in Canada for too long,” McArthur told Skies. “We are targeting markets where the airfares are highest because that is where the opportunity is. We are not interested in stealing market share from our competitors, we want to inspire more people to fly by making air travel more affordable.”

So, How Low Can You Go?

The Canadian aviation marketplace brings its own unique challenges for any ULCC joining this rapidly growing segment, beginning with a relatively low population spread over an immense geographical area. Combine this with the fact that taxes and fees in Canada are higher than in other countries where ULCCs are successfully operating — and the fact that Canada has fewer secondary airports with lower fees that ULCCs could use as destinations — and you have yourself a whole new ball game.

In this Internet Age, it is easy to search the incredibly low fares being offered by ULCCs, as well as read customers’ experiences and feedback on their flights. As with any new service, success or failure often depends on the gap between what is being offered, and what is received or perceived from a customer’s perspective.

As the competition in this ULCC marketplace becomes more and more severe, it will be interesting to see what level of sparse services and bare-bone fares can be offered — all the while keeping the ULCC in question operationally sound, and financially viable.

How low can you go ?

Some Captain wages are equivalent of traditional airline First Officer, and first officer just above experience flight attendant.

Wow! Suprise we are going trough a pilot shortage. Who would spend 90 000$ for that type of job ???

Exactly Steve. I don’t have a problem with these ULCCs. I DO have a huge problem with doing it in the back of employees. These salaries are pathetic for the responsibility they carry. Why pilots even accept these jobs will always be beyond my comprehension. I’ve heard every excuse though