Estimated reading time 6 minutes, 30 seconds.

The latest data from WingX, a research and consulting company focusing on the business aviation industry, reveals a substantial decline in business jet activity in late May 2023 compared to the same period last year. However, the numbers continue to outperform the figures from 2019.

The industry is grappling with challenges in the charter market as well as growing concerns about sustainability. According to WingX, while charter bookings for summer 2023 remain strong, they may be impacted by a deteriorating macroeconomic environment.

Global Overview

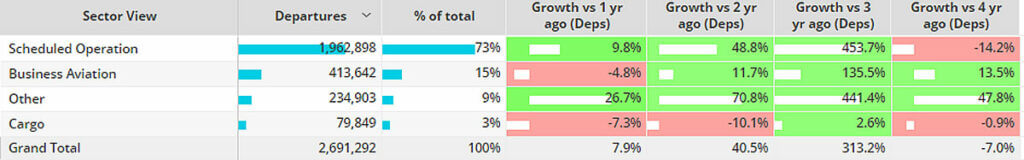

During the final week of May, global business jet activity dropped by nine percent compared to the same period in May 2022. This further widened the month-to-date decline to seven percent compared to last year. Year-to-date, global business jet activity has decreased by five percent compared to the previous year, but remains 17 percent higher than in 2019. In contrast, global scheduled airline activity has shown a 10 percent increase compared to last year, although it still lags behind May 2019 by 14 percent. Notably, the top five global airlines have operated seven percent more sectors (flights from A to B) this month compared to four years ago.

North America Insights

In late May, business jet sectors in North America experienced a 10 percent decline compared to the same period in 2022. Over the past four weeks, activity fell eight percent behind last year’s figures.

Notably, 59 percent of business jet flights in North America in the month of May had durations of less than 90 minutes — showing a five percent decrease compared to last year, but an 11 percent increase compared to 2019. Flights lasting between 1.5 to three hours have witnessed the largest surge since pre-pandemic May, with a significant 28 percent increase. However, ultra-long-range flights (12+ hours) have experienced a sharp decline of 31 percent compared to May last year.

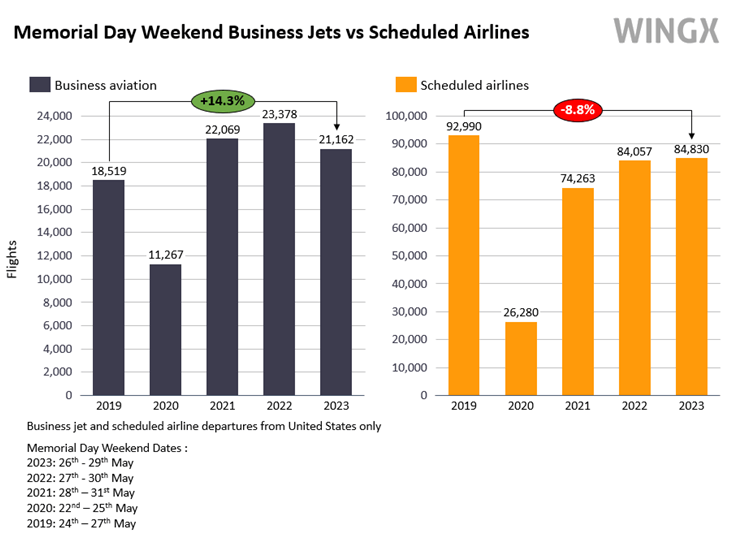

During the Memorial Day weekend (May 26 to 29), business jet activity in the United States saw a 14 percent increase compared to the same holiday weekend in 2019, but it was nine percent lower than last year’s Memorial Day dates. Scheduled airline activity, on the other hand, experienced a nine percent decline this year compared to the 2019 holiday weekend.

Demand among the top business jet operators in the U.S. varied throughout May 2023. NetJets’ U.S. departures decreased by one percent compared to last year, but remained 30 percent higher than in 2019. Flexjet, on the other hand, recorded a 10 percent increase in departures compared to last year, representing a significant 96 percent surge from 2019. However, JetIt’s U.S. departures plummeted by 41 percent compared to May 2022.

Europe Market Highlights

In the last week of May, European business jet sectors fell 11 percent behind the same period in 2022. Over the past four weeks, activity remained 10 percent below last year’s figures, but maintained a 7 percent lead over 2019.

Major European markets have experienced declines in bizjet activity during May. France, the busiest market, saw departures decrease by eight percent compared to last year, while the United Kingdom and Germany witnessed double-digit declines. Portugal, however, bucked the trend with a notable 21 percent increase in departures compared to May 2022.

During this year’s European Business Aviation Convention & Exhibition (EBACE), held from May 23 to 25 in Geneva, Switzerland, there were 187 bizjet arrivals at Geneva Airport, representing a 10 percent decrease compared to EBACE 2022.

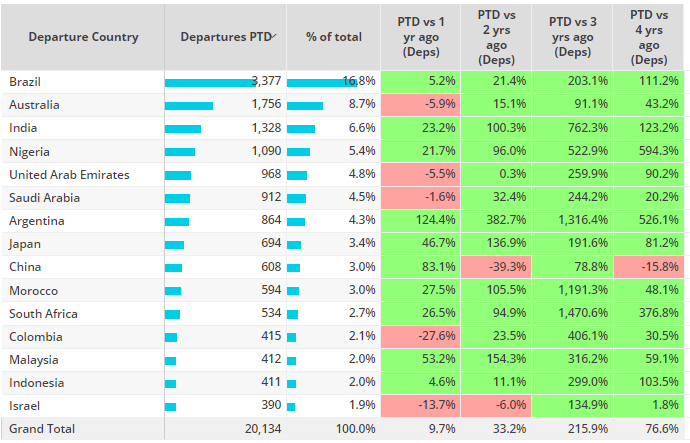

Rest of the World Overview

During the month of May, business jet departures outside of North America and Europe showed a promising trend, with a 10 percent increase compared to last year. However, the busiest markets have experienced some declines compared to May 2022, including Australia (-6 percent), United Arab Emirates (-6 percent), and Saudi Arabia (-2 percent). Business jet departures from China have decreased by 16 percent compared to May 2019, but have rebounded significantly by 83 percent compared to last year’s figures.