Estimated reading time 8 minutes, 13 seconds.

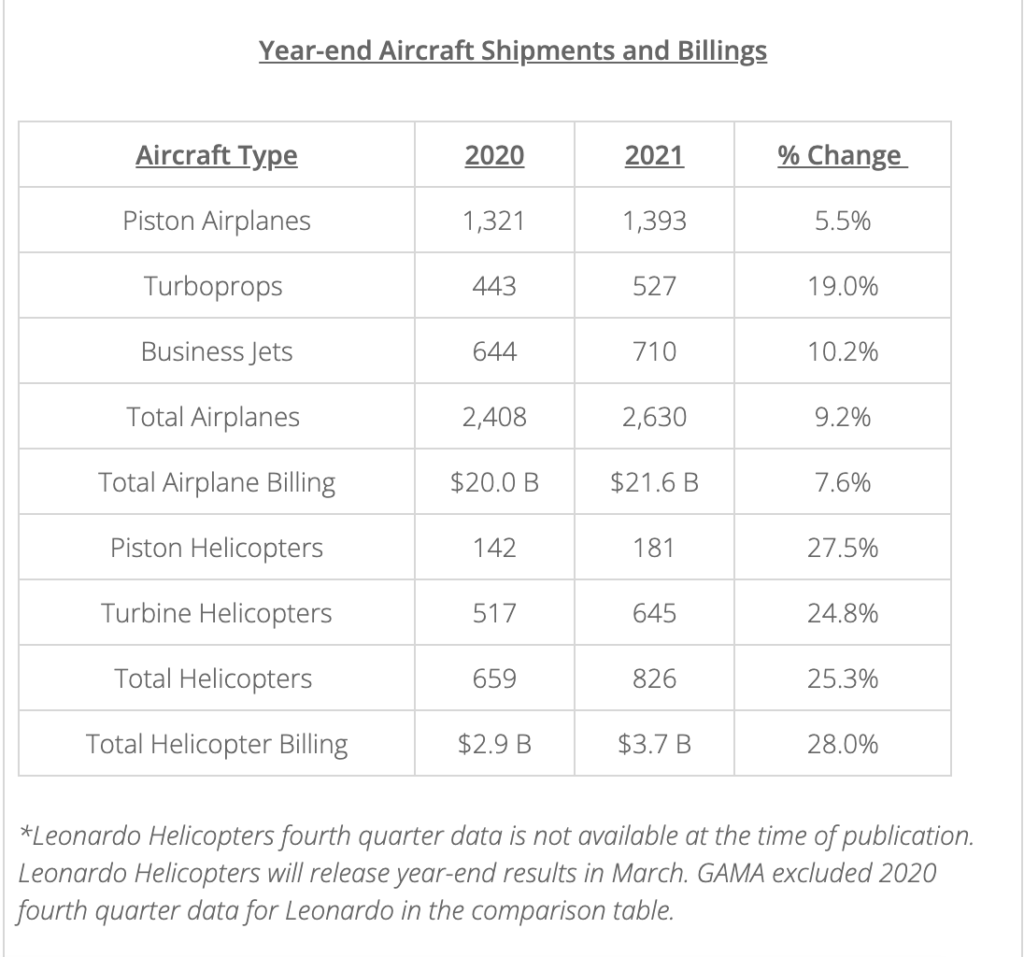

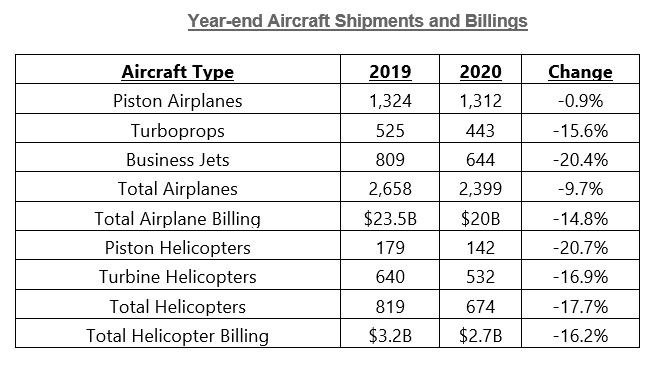

The General Aviation Manufacturers Association (GAMA) on Feb. 23 released the 2021 General Aviation Aircraft Shipments and Billings Report during its annual State of the Industry press conference. According to the report, all aircraft segments saw increases in shipments in 2021, when compared to 2020. Preliminary aircraft deliveries, including piston and turbine helicopters, were valued at $25.2 billion, which is an increase of 10.2 percent. The data led panelists participating in the State of the Industry press conference to acknowledge that 2021 was “the turn of a corner.”

Turboprop airplanes in 2021 saw the biggest change over 2020 with a 19 percent increase in deliveries, which translates to 527 units. Piston airplane deliveries increased 5.5 percent, with 1,393 units, while business jet deliveries increased 10.2 percent, with 710 units. The strong recovery of the bizjet segment has largely been driven by new users and new buyers, Michael Amalfitano, GAMA chair and president and CEO of Embraer Executive Jets, said during the press conference.

The preliminary value of exclusively airplane deliveries increased 7.6 percent in 2021, which translates to $21.6 billion.

Once again, Textron Aviation led airplane shipments in 2021 with 546 total units, with Cirrus not far behind logging 528 total units. Pilatus led airplane shipments among the business jet manufacturers, with 135 total units – which translates to total billings of $990,658,000. Gulfstream recorded total billings of $6,341,500,000 in 2021, with 119 shipments. Montreal, Quebec-based Bombardier logged 120 shipments in 2021, with total billings of $5,751,000,000. The manufacturer’s Global family of aircraft were the most popular among its lineup.

Embraer’s Phenom 300 series in 2021 was the most delivered twinjet, with 56 units delivered. While Honda Aircraft Company’s HondaJet was the most delivered aircraft in its class for the fifth consecutive year, with 37 units delivered. The type also recently surpassed 100,000 flight hours, according to Honda Aircraft.

GAMA’s report reveals that North America continues to lead the market across all segments. The piston airplane market in North America accounted for 68.7 precent of overall shipments, with the second largest market being Asia-Pacific (for the seventh year in a row), accounting for 14 percent of total piston airplane shipments. Turboprop airplane shipments to North American customers accounted for 52.6 percent of the total deliveries, with the second largest market being Latin America at 15.7 percent. Lastly, the North American market accounted for 65.9 percent of business jet deliveries in 2021. The second largest market for bizjet deliveries during the year was Europe at 18.0 percent.

“The strength and tenacity of the general aviation industry has provided a strong foundation for the industry to rebound from pandemic-related setbacks with a powerful showing in 2021,” said Pete Bunce, GAMA President and CEO. “Total aircraft shipments are converging on figures that were seen before the outset of the pandemic. The industry has been able to weather the storm by strategically managing workforce and supply chain challenges, which unfortunately are still ongoing. Despite this adversity, there is robust interest and excitement in our industry.”

GAMA chair and Embraer president Amalfitano said the strength of the industry is first and foremost driven by demand, and “the demand was absolutely off the charts during the pandemic period, especially in 2021.” The drivers supporting that demand, he said, included high-net-worth individual growth, and strong economies in the U.S. and globally.

Of course, the demand is not only for new aircraft, but pre-owned aircraft, too. “The pre-owned aircraft marketplace is at record low levels — single-digit percentages,” said Amalfitano. “You can’t even find an airplane in the marketplace, and that’s allowed the OEMs to have a much stronger opportunity to balance units and pricing discipline to support the strength of the industry going forward.”

He confirmed that at the OEM level, things are faring quite well, as backlogs are anywhere from one to two years, or longer. “Most of the OEMs are looking at selling aircraft into 2024. That’s a very exciting opportunity for the industry.”

Amalfitano acknowledged that while there is strength in the industry, there are headwinds, too. Certainly, there are supply chain issues in terms of not being able to get the required parts to produce a product, as well as increased commodity pricing adding pressure to being able to meet such demand.

On the training side, demand has also come roaring back from the slump in 2020, according to Eric Hinson, GAMA vice chair and CEO of SimCom International. While revenue in the training business was nearly cut in half 18 months ago, “the resilience of the market really has been impressive,” said Hinson during the press conference. “We saw a pretty significant recovery through 2020, but 2021 was just exceptional. The demand is as much as we can handle right now from a training perspective.

“Of course, to meet all this demand that our OEMs are supplying us with, from a training perspective, we need to make sure that there’s an adequate supply of well-trained pilots,” he continued.

Hinson had a few things to add about the pilot shortage, noting there are reasons to be optimistic. “The last Boeing forecast I think was 600,000 pilots over the next 20 years, and that doesn’t include some of these emerging markets like advanced air mobility and so forth,” he said. “There’s no question we need a lot of pilots.”

While the number of licensed pilots in the U.S. has decreased over the last decade, Hinson said the good news is that “if you look at student pilot certificates [from 2012 to 2021], we’ve gone from about 119,000 to 250,000 student pilot licenses in 2021. And most of that increase has occurred really in the last three or four years. . . . And we’ve seen a continual escalation in the compensation that pilots are receiving. . . . So, we’re seeing a lot more pilots starting training now. And I really do feel much more optimistic now than I did maybe a year ago.”