Estimated reading time 7 minutes, 52 seconds.

In case there was any lingering doubt, Canada’s commercial aviation market suffered an historic downturn in 2020, and while there was a period of recovery last year, the resurgent Covid-19 pandemic is again tempering optimism about 2022.

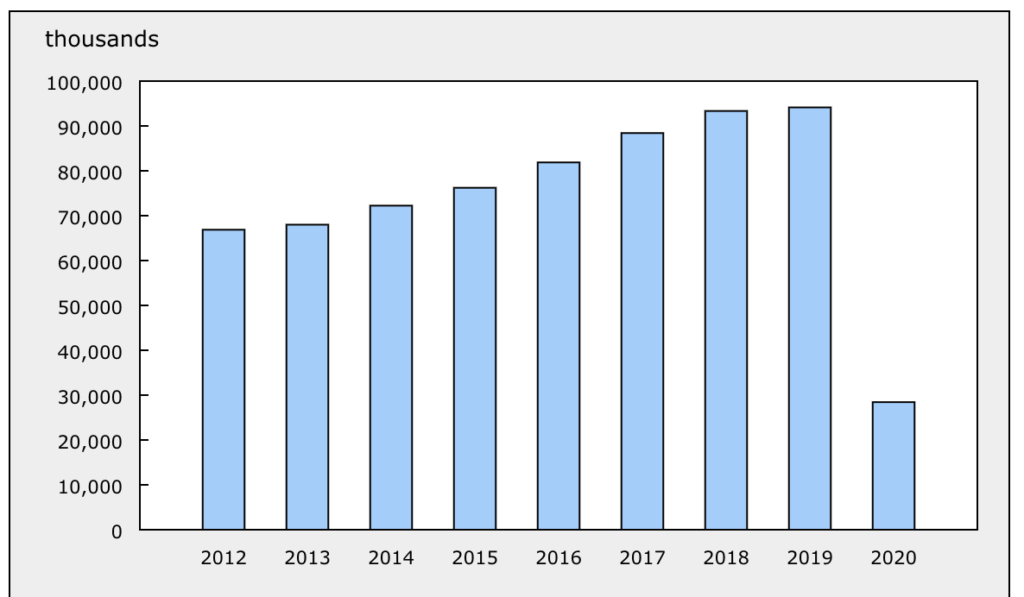

This gloomy scenario is courtesy of Statistics Canada, which confirmed in a Jan. 21, 2022, report that after 10 consecutive years of traffic growth, Canada’s Level I, II and III carriers in 2020 transported less than one third (30.2 percent) of the 94.1 million passengers carried in pre-pandemic 2019. This translates to 28.4 million passengers carried in 2o20.

Most of the 2020 loads occurred in the first two months of the year before the pandemic really took hold, and the year’s total was the lowest since the recessionary early 1990s.

Scheduled-service passengers in 2020 plunged 71 percent from the previous year to to 26.5 million, while charter loads fell 32.8 percent to 1.9 million. The impact was diverse: down 66.4 percent domestically to 16.4 million passengers, and down 73.4 percent internationally to 12.1 million passengers.

“As travel restrictions eased amid an increasing vaccination rate and declining Covid-19 cases, Canadian airlines started to add flights and restore some routes during the summer of 2021 and into the fall,” the agency said.

October 2021 saw combined scheduled service and charter passengers top 3.1 million for the first time since March 2020, but StatCan said the apparent beginning of “a recovery phase of sorts” may be short-lived “as uncertainty returned for the industry when the World Health Organization declared a new variant of concern, Omicron, in late November 2021.”

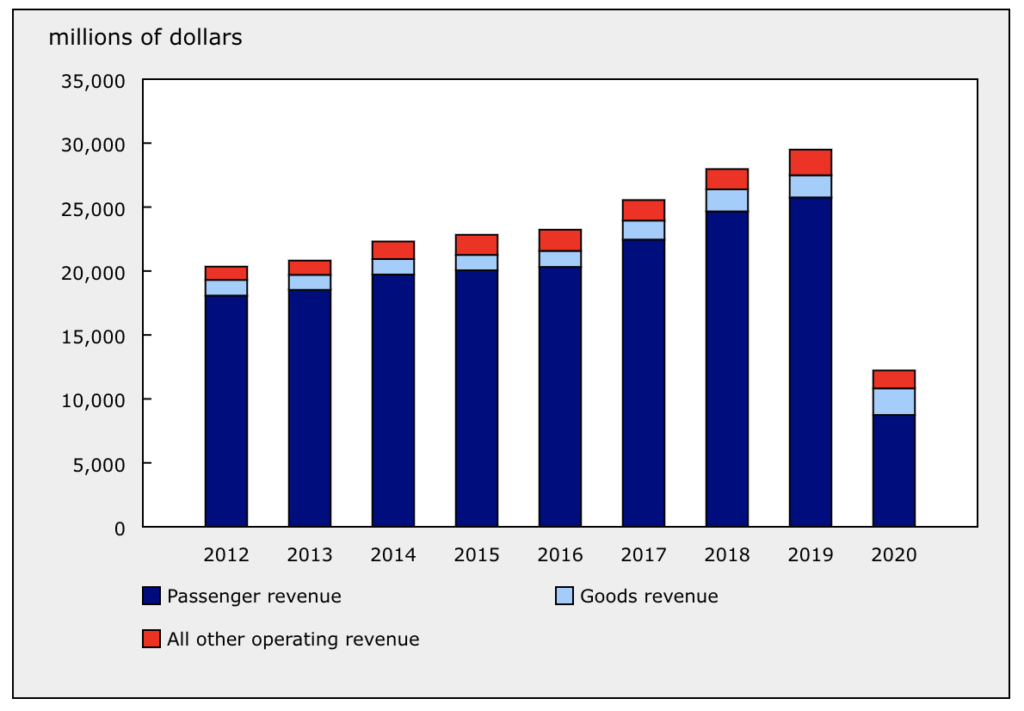

Carriers’ operating revenues nosedived to $12.2 billion in 2020, some 41 percent below year-earlier levels. The picture would have been much bleaker, except for the fact that a 20 percent increase in cargo revenues to $2.1 billion partly offset a 66.1 percent plunge to $8.7 billion on the passenger side of the ledger.

The upsurge in cargo revenues was due to pandemic-driven increases in demand for medical and pharmaceutical goods, among other things.

In the airline industry, “profits vanished . . . as net operating income decreased by $5.1 billion, after a $330.7 million increase in 2019,” the agency said. “Total operating revenue . . . fell 58.6 percent from a year earlier to $12.2 billion. . . . Several airlines suspended their operations or drastically curtailed schedules in response to travel restrictions and border closures implemented around the world.”

There was, of course, a significant drop (44.7 percent) in airlines’ operating expenses as fleets were grounded and property rentals and taxes were affected by layoffs. Actual aircraft operating costs fell 54.1 percent and deferred aircraft maintenance costs saw those bills fall 22 percent.

The bottom line, however, reflected the reality that operating expenses of $15.1 billion outpaced $12.2 billion in operating revenues. That meant the industry incurred $1.24 in operating expenses for every dollar earned.

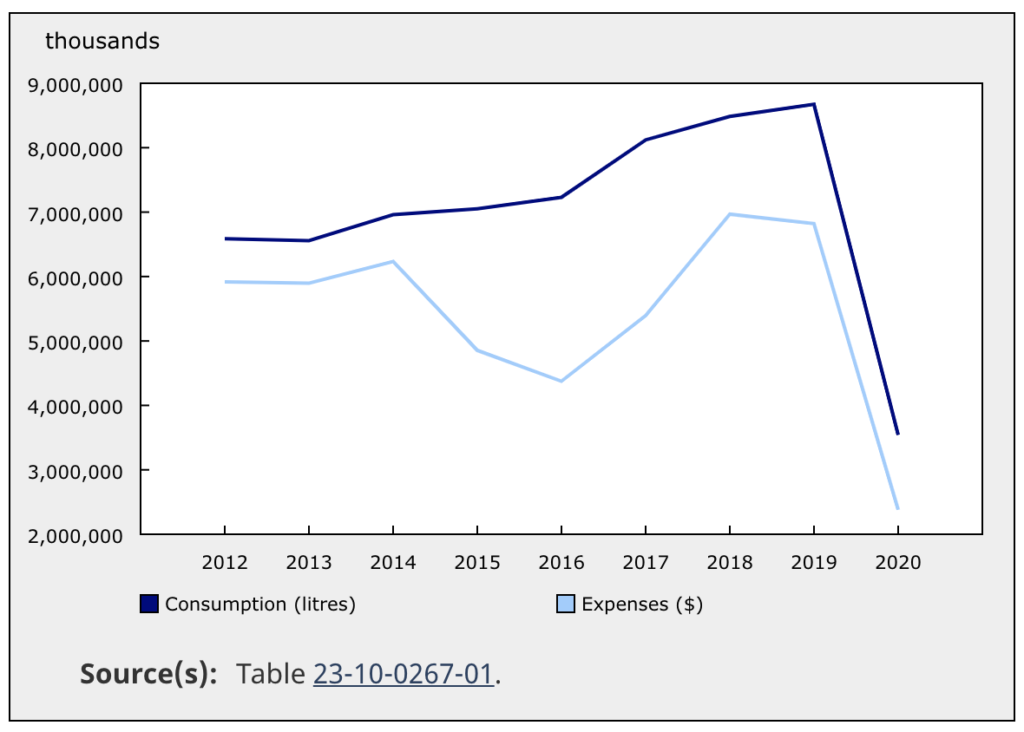

Predictably, the carriers’ combined turbo fuel consumption in 2020 was down 59.1 percent from a year earlier at 3.6 billion litres. The $2.4 billion spent on fuel accounted for 15.9 percent of overall operating costs, compared with 25 percent in 2019. The decline reflected a 34.7 percent decline in aviation fuel prices over the year, and fewer hours flown (1.5 million, down 55.8 percent).

Employment fell 32.7 percent to 47,304 in 2020, due to furloughs and temporary — albeit often lengthy — layoffs. Airlines paid $3.5 billion in employees’ salaries and wages — though federal government subsidies provided some support — accounting for 23.3 percent of overall operating expenses.

Subsequent 2021 International Air Transport Association (IATA) data show that demand as expressed in revenue passenger kilometers (RPKs) fell 58.4 percent from a pre-pandemic 2019; 2020 RPKs were down 65.8 percent from 2019.

The IATA said its decision to compare last year with 2019 was that “comparisons between 2021 and 2020 results are distorted by the extraordinary impact of Covid-19.”

International demand in 2021 was down 75.5 percent in the two-year period; capacity as measured in available seat kilometers (ASKs) fell 65.3 percent, and load factor by 24 percent. Domestic demand in 2021 was down 28.2 percent, capacity by 19.2 percent and load factor by 9.3 percent.

In December, as the Omicron variant swept around the world, total traffic was 45.1 percent below December 2019 — an improvement from a 47 percent drop in November as monthly demand continued to recover, despite concerns about the latest coronavirus variant.

“Omicron travel restrictions slowed the recovery in international demand by about two weeks in December,” IATA said. “International demand has been recovering at a pace of about four percentage points/month compared to 2019. Without Omicron, we would have expected international demand for the month of December to improve to around 56.5 percent below 2019 levels. Instead, volumes rose marginally to 58.4 percent below 2019 from under 60.5 percent in November.

“Overall travel demand strengthened in 2021,” a trend that continued into December despite travel restrictions. “That says a lot about the strength of passenger confidence and the desire to travel,” IATA director general Willie Walsh said. “The challenge for 2022 is to reinforce that confidence by normalizing travel.”