Estimated reading time 6 minutes, 34 seconds.

During this year’s Canadian Business Aviation Association (CBAA) Convention & Exhibition in Toronto, Rolland Vincent, director and creator of JETNET iQ, presented the aviation market research company’s 2022 business aviation outlook. He began by sharing an equation with attendees to summarize the state of the industry: the current “white-hot” demand combined with constrained supply means buyers will need to “wait in line and pay the price.”

“White-hot demand is our challenge,” said Vincent. “It’s a great problem to have. But we’re trying to figure out how to get the supply chains working.”

Currently, OEM book-to-bill ratios — orders coming in versus units being shipped — are reaching unprecedented levels.

“A 1.0 book-to-bill ratio is where orders and deliveries are matched. Our industry is right around 2.5 right now. This is not sustainable,” explained Vincent, “but boy, it’s really good for [the OEMs], and it’s good for their margins.”

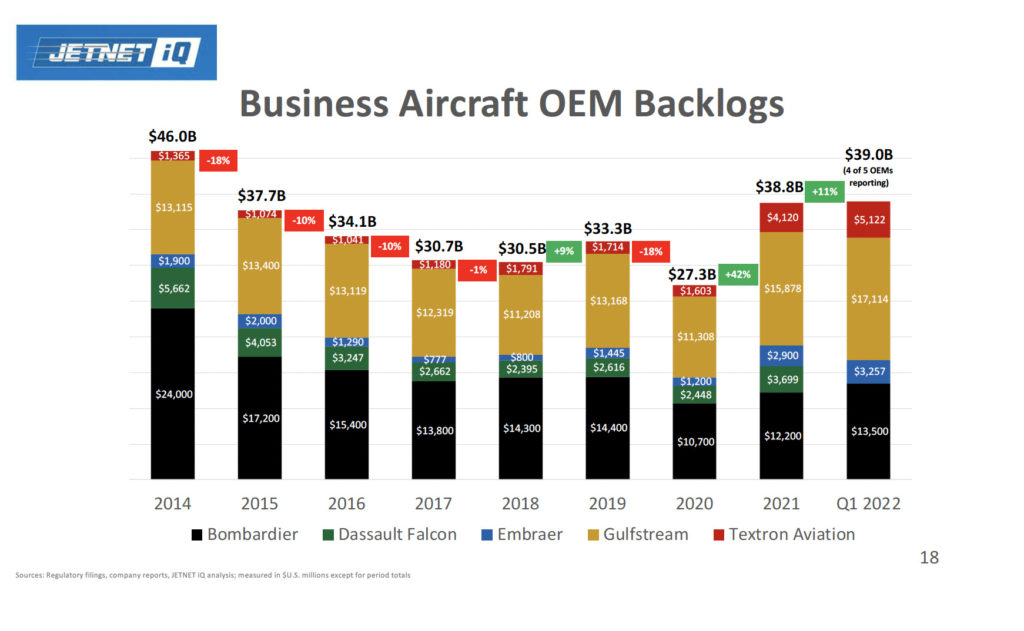

This means order backlogs are surging, too.

“Backlogs have been declining in our industry for about 10 years, up until 2018, from 10 years of slow burn down. . . . In 2019, finally backlogs went up. In the first three months of this year, we were up 11 percent in value of the whole backlog, already. This is a good place to be.”

While this year is a bit slower in terms of deliveries, in large part due to supply chains not responding, Vincent expects deliveries to increase “around 16 percentage points” from 2021 through 2023.

Particularly, he sees the large jet class continuing to grow in deliveries over the next three years, while the small and medium class jets are “a little bit softer.” Part of that is due to some of the small- and medium-sized fleet continuing to age, and customers wanting to move on to other aircraft that are newer, according to Vincent.

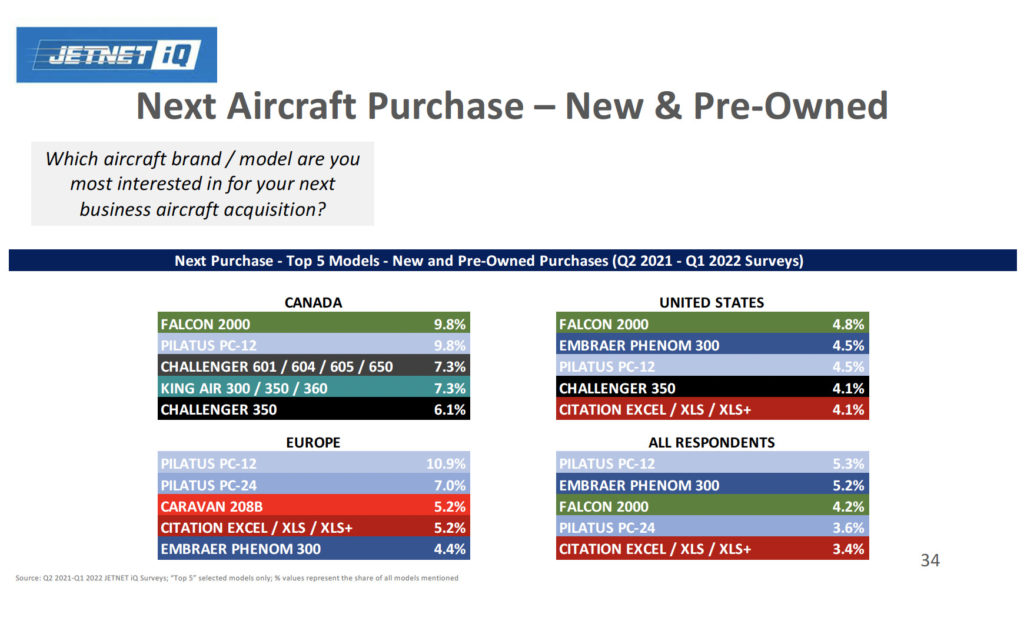

Demand for pre-owned business aircraft is just as high as new aircraft, which is reflected in the very small percentage of aircraft for sale — particularly in Canada. Currently, there are 1,321 business jet and turboprop aircraft based in Canada. Of that fleet, only 35 aircraft are listed for sale — which translates to 2.6 percent.

“Historically, since we’ve been measuring these data, a typical market sees nine to 10 percent of aircraft listed. . . . There’s no way this market can bear the volume of sales that we’re experiencing at that 2.6 number.”

Data show that the industry has more than recovered from the effects of the pandemic — and that includes part 91, part 135 (on-demand charter), and part 91 subpart K (fractional) operators. The latter has “been on fire,” said Vincent.

Business jet flight activity for these three types of operators had surpassed 2019 levels in 2021. And in the first quarter of 2022, flight activity had already surpassed 2021 levels.

In JETNET’s latest survey, which it sent to owners and operators of fixed-wing turbine-powered business aircraft, the firm asked organizations if they think the increased utilization in fractional/charter operations seen over the past 12-18 months will continue into the future. Thirty-eight percent of North American respondents said they strongly agree, while 39.5 percent said they somewhat agree.

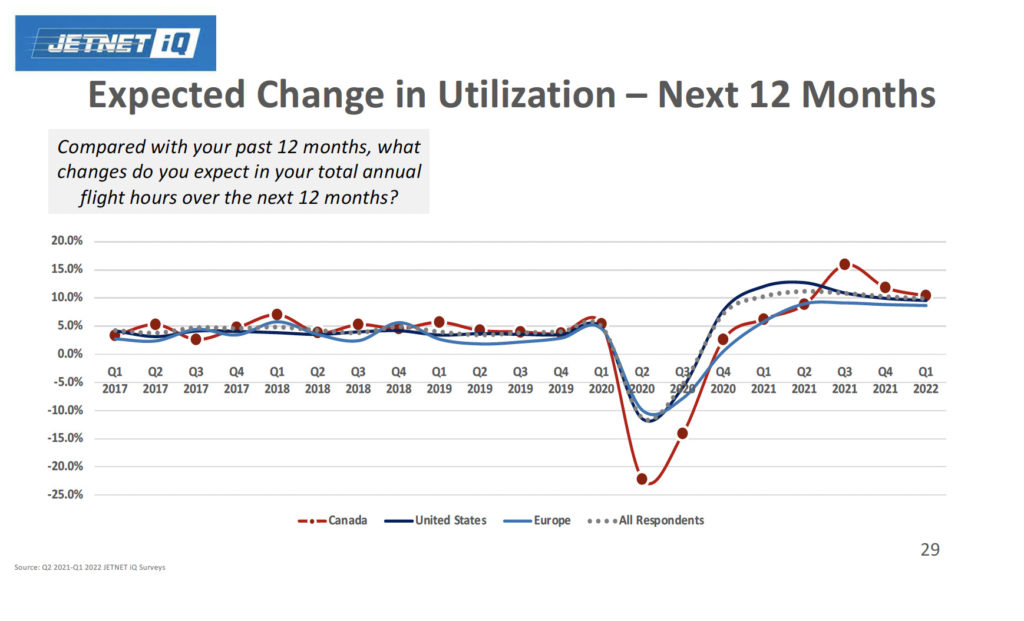

A similar question was asked about what changes owners/operators expect in their total annual flight hours over the next 12 months. The responses were unanimously positive, showing that “there’s still an expectation of growth going forward in our industry,” said Vincent.

However, in terms of the probability of purchasing a new fixed-wing turbine aircraft over the next 12 months, 59 percent of organizations in Canada said there is a zero percent chance they will buy a new plane, and only 3.2 percent said there’s an 81-100 percent chance. The latter percentage was slightly higher in the U.S., at 7.6 percent.

According to the survey results, the number one reason stopping Canadian operators from purchasing new airplanes right now is that they feel they already have enough aircraft.

Vincent said that while his firm believes “the market peaked six months ago, at a very high point — the highest we’ve ever seen — we’re still in a very optimistic situation right now.”