Estimated reading time 8 minutes, 1 seconds.

Aéroports de Montréal (ADM) announced its consolidated operating results for the three and nine months ended Sept. 30, 2020. These results are accompanied by passenger traffic data from YUL, Montréal-Trudeau International Airport.

“The results for the third quarter of 2020 are very disappointing, but hardly surprising,” said Philippe Rainville, President and CEO of ADM Aéroports de Montréal. “At YUL, the corridors and parking lots are empty, passengers are scarce, and some of our boarding gates are closed. While our industry has always been resilient in the past, the situation has never been this bad. It is high time to review the strategy in this country and put in place new measures that will allow airlines and airports to safely restart operations, such as rapid testing to reduce the quarantine period. The survival of all players in the airline and tourism sectors in our beautiful city is at stake.”

“The results for the third quarter of 2020 are very disappointing, but hardly surprising,” said Philippe Rainville, President and CEO of ADM Aéroports de Montréal. “At YUL, the corridors and parking lots are empty, passengers are scarce, and some of our boarding gates are closed. While our industry has always been resilient in the past, the situation has never been this bad. It is high time to review the strategy in this country and put in place new measures that will allow airlines and airports to safely restart operations, such as rapid testing to reduce the quarantine period. The survival of all players in the airline and tourism sectors in our beautiful city is at stake.”

Highlights

Passenger numbers at YUL continue to show a sharp decline and stood at 608,600 passengers in the third quarter of 2020, a decrease of 89.9 per cent compared with the same period in 2019. This decline is directly related to the international health crisis associated with COVID-19 and the negative impact it is having on domestic, transborder and international traffic.

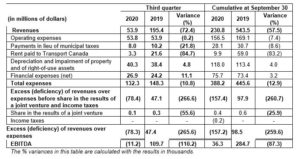

EBITDA (excess of revenues over expenses before financial expenses, taxes, depreciation, impairment and share in the results of a joint venture) was negative by $11.2 million for the third quarter of 2020, down $120.9 million, or 110.2 per cent, from the same period a year earlier. For the period ended Sept. 30, 2020, EBITDA totalled $36.3 million, a decrease of $248.4 million, or 87.3 per cent, over the corresponding period of 2019.

ADM’s capital investments were $42.6 million during the third quarter of 2020 and $202.9 million during the first nine months of 2020 ($107.6 million and $224.1 million, respectively, in 2019). Airport investments for the first nine months of the year were financed by cash flow from operating activities, including airport improvement fees, as well as by long-term debt.

Financial results

Consolidated revenues were $53.9 million in the third quarter of 2020, a decrease of $141.5 million, or 72.4 per cent, over the corresponding period of 2019. Cumulative revenues as at Sept. 30, 2020 totalled $230.8 million, a decrease of $312.7 million, or 57.5 per cent, from 2019. This result is a consequence of the current pandemic and the strategy put in place in Canada to manage it.

Operating expenses for the quarter under review remained relatively stable at $53.8 million, a decrease of 0.2 per cent over the previous year. For the period ending Sept. 30, 2020, operating expenses decreased by $12.6 million, or 7.4 per cent, from $169.1 million to $156.5 million.

The pandemic has had an impact on the financial capacity of retail tenants to pay a guaranteed minimum rent given the reduced level of activity. As a result, ADM expects to provide these tenants with relief for the year 2020. These measures are currently not reduced from revenues but rather recorded as operating expenses. Had it not been for the accounting treatment of these relief measures, revenues would have been $31.0 million and $207.9 million, respectively, for the three-month and nine-month periods ended September 30, 2020. As for operating expenses, these would have totalled $30.9 million in the third quarter of 2020, down 42.7 per cent from the same quarter of 2019, and $133.6 million at Sept. 30, 2020, a reduction of 21 per cent from the corresponding period of 2019. ADM has adopted initiatives to reduce operating costs, particularly those related to reduced airport activities and the temporary closure of certain areas of the terminal building. In addition, ADM reduced its workforce by 30 per cent, implemented salary reductions, and by participating in the Canada Emergency Wage Subsidy Program.

Transfers to governments (payments in lieu of taxes to municipalities and rent to Transport Canada) amounted to $11.3 million for the third quarter and $38.0 million for the first nine months of 2020 ($31.8 million and $89.7 million, respectively, in 2019). This decrease is mainly due to lower revenues and the rent exemption granted by Transport Canada. This exemption represents a savings of $15.1 million for the cumulative period ending Sept. 30, 2020.

Depreciation and impairment of property and equipment and right-of-use assets amounted to $40.3 million during the three months ended September 30, 2020, an increase of $1.9 million, or 4.8 per cent, over the same period in 2019. This expense amounted to $118.0 million in the first nine months of 2020, an increase of $4.6 million, or 4.0 per cent, compared with the corresponding period in 2019. This increase is mainly due to the commissioning of projects completed during 2019.

Net financial expenses totalled $26.9 million for the quarter under review, an increase of $2.7 million, or 11.1 per cent, over the same period last year. Cumulative net financial expenses as at Sept. 30, 2020 totalled $75.7 million, an increase of $2.3 million, or 3.2 per cent, compared with the corresponding period in 2019. The variance in the latter is mainly due to the increase in interest expense following the issuance of Series R bonds in April 2020, partially offset by the interest income generated by surplus cash.

For the quarter ended September 30, 2020, there was a deficiency of revenues over expenses of $78.3 million compared to an excess of revenue over expenses of $47.4 million for the same period in 2019, a decrease of $125.7 million. At Sept. 30, 2020, the deficiency of revenues over expenses was $157.2 million, a decrease of $255.7 million compared with the first nine months of 2019.

EBITDA is a financial measurement that is not recognized by International Financial Reporting Standards (IFRS). It is therefore unlikely to be comparable to similar measures used by other entities. EBITDA is defined by ADM as the excess of revenues over expenses before financial expenses, taxes, depreciation, impairment and share in the results of a joint venture. It is used by management as an indicator to evaluate operational performance. EBITDA is meant to provide additional information and is not intended to replace other performance measures prepared under IFRS.

Outlook for 2020 and 2021

Continued border closures with the United States and other international destinations, the 14-day mandatory quarantine, and the lack of a vaccine to counter the effects of COVID-19 will continue to negatively affect passenger traffic, carrier activities, and ADM’s financial results. ADM continues to monitor the situation to respond quickly to changes, namely by implementing cost-cutting measures. Once passenger traffic returns to more normal levels, ADM will focus on critical capital projects, namely those related to the maintenance of its assets as well as those required to replace assets that have reached the end of their useful life, in accordance with its obligations under the land lease linking ADM to the Government of Canada. The lower level of activity would be an ideal time to proceed with the rehabilitation of one of its runways. Due to a lack of financial resources, this work will have to be done when the level of activity is significantly higher, making the project more complex and more expensive to carry out.

Passenger traffic

For the third quarter of 2020, traffic at YUL totalled 608,600 passengers, a decrease of 89.9% compared with 2019. International traffic decreased by 92.3%, transborder traffic (United States) saw a 97.0% decline, and domestic traffic fell by 82.9% compared with the third quarter of 2019.

Cumulative passenger traffic declined by 69.1% in the first nine months of 2020, to 4.9 million. International passenger traffic dropped by 68.3%, transborder (U.S.) passenger traffic decreased by 71.9%, and domestic passenger traffic fell by 68.4% compared with the same period last year.