Estimated reading time 12 minutes, 35 seconds.

Exchange Income Corporation (TSX: EIF) (“EIC” or the “Corporation”) a diversified, acquisition-oriented company focused on opportunities in the aviation, aerospace and manufacturing sectors, reported its financial results for the three-months ending March 31, 2021. All amounts are in Canadian currency.

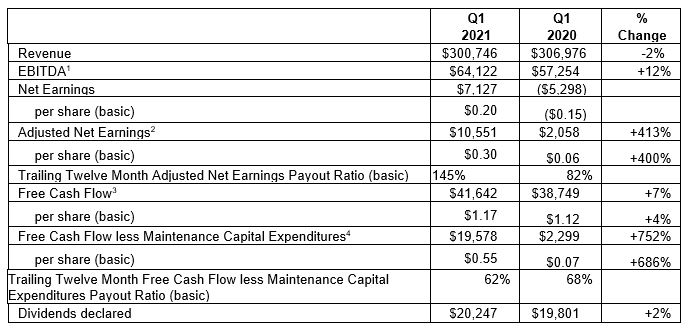

Q1 Financial Highlights

- Generated Revenue of $301 million, a decrease of $6 million or 2% compared to $307 million in the prior period

- Consolidated EBITDA of $64 million, an increase of $7 million or 12% from $57 million in the prior period

- Free Cash Flow less Maintenance Capital Expenditures rebounded near pre-pandemic levels, producing $20 million or $0.55 per share compared to $2 million or $0.07 per share in the prior period

- Adjusted Net Earnings of $11 million or $0.30 per share compared to $2 million or $0.06 per share in the prior period

- Trailing Twelve Month Free Cash Flow less Maintenance Capital Expenditures payout ratio improved to 62% from 68% at March 31, 2020

CEO Commentary

Mike Pyle, CEO of EIC, commented, “The leadership teams at our subsidiaries have done a remarkable job over the past year. Through their dedication, ingenuity and resolve, they have successfully met the many challenges posed by the pandemic including protecting their customers and employees, dealing with sudden, dramatic shifts in business volumes, delivering essential, frontline services to our remote, northern communities and providing essential products to our customers. Throughout all of this, the management teams have never lost their focus on the business, as evidenced by this past quarter’s results. For evidence of this, you need only to look at our Trailing Twelve Month Free Cash Flow less Maintenance Capital Expenditures payout ratio which, at 62%, is lower than it was a year ago.”

Selected Financial Highlights

(all amounts in thousands except % and share data)

Review of Q1 Financial Results

Revenue generated by the Corporation during the first quarter was $301 million, a decrease of $6 million or 2% from the comparative period. Revenue in the Aerospace & Aviation segment decreased by $17 million while revenue in the Manufacturing segment increased by $11 million. COVID-19 impacted revenues for the entire quarter this year as opposed to the first quarter of 2020, which experienced strong revenues in the first two months before the onset of the pandemic in March. Decreased demand for travel has been the single biggest factor impacting the Aerospace & Aviation segment revenue, reducing passenger volumes in our airlines and cutting the need for Regional One’s parts and service and leasing businesses. Notably, the overall industry has improved from its lows and travel in certain jurisdictions has started to resume, and Regional One experienced a sequential improvement compared to the fourth quarter of 2020 from parts sales and lease revenue. These reductions compared to the prior period were partially offset by improvements in cargo, charter, rotary EMS and aerospace revenue, including greater on-demand ISR aircraft utilization. The increase in Manufacturing segment revenue is mainly attributable to the acquisition of WIS in the third quarter of 2020.

EBITDA generated by the Corporation during the first quarter was $64 million compared to $57 million in the comparative period, an increase of 12%. EBITDA in the Aerospace & Aviation segment was up $4 million compared to the prior period. While scheduled passenger operations continued to feel the impact of COVID-19, strong cargo, charter and rotary wing operations, and improvements in the aerospace operations, helped mitigate these reductions. Provincial’s aerospace operations benefitted from contract price and scope escalators and increased on-demand ISR aircraft utilization. Additionally, cost reduction measures through scheduled frequency reductions, labour rationalization and various other strategies that took some time to implement in 2020 were meaningfully realized in the first quarter of 2021. Regional One’s EBITDA was directly impacted by the reduction in revenue. EBITDA in the Manufacturing segment also increased by $4 million. EBITDA at Quest was higher than the prior period reflecting the acquisition of WIS in the third quarter of 2020 with no comparative in the first quarter of 2020. The balance of the segment collectively also experienced an increase in EBITDA.

Carmele Peter, EIC’s President, stated, “There have been numerous challenges for our teams this quarter. Flight operations have had to react to changing vaccine rollout strategies and regions coming into and out of restrictions. Manufacturing facilities have experienced delays and inefficiencies as health restrictions change and we manage health and safety protocols to keep our employees safe. In addition, required employee absenteeism has provided an additional challenge for management. Quest even had to deal with a March snowstorm that caused production interruptions at its Texas facility for several days. Throughout all of this, our teams have made thoughtful decisions that protect our employees and customers while also providing the best path forward for the business.”

Darryl Bergman, CFO of EIC, also noted. “The last year has been a challenge for companies around the globe and the airline industry is one of the most severely impacted industries. These past twelve months have proven that, with EIC’s unique collection of well-managed companies in niche businesses, we are not a typical aviation company. During this time, we have remained extremely active, fully investing in Maintenance and Growth Capital Expenditures, acquiring companies and continuing to pay our monthly dividend while also reducing our debt, net of cash. Clearly, investors also see the value of the business model, as evidenced by the success of our $80 million bought deal share offering subsequent to the end of the quarter. Finally, I am pleased to announce that Richard Wowryk, formerly EIC’s Corporate Controller, has been promoted to the position of EIC’s Chief Accounting Officer.”

Outlook

“We are beginning to see positive signs across our existing businesses,” continued Mr. Pyle. “The pace of vaccine distribution in Canada is accelerating and the US has already vaccinated a substantial portion of its population. We can now envision a time in the not-too-distant future when life returns to something that looks more normal. At EIC, we have a proven track record of successfully growing our business through accretive acquisitions, and we need to be ready to move when we identify opportunities. This thinking underpins the recent completion of our $80 million bought deal public offering of common shares. We expect to grow, and our acquisition team is actively assessing potential opportunities. We also understand the imperative of maintaining a strong balance sheet. This infusion of liquidity will help us meet both objectives.”

Mr. Pyle concluded by saying, “So, while management is maintaining our caution in the face of a pandemic that continues to prove unpredictable in domestic and international markets, EIC is also extremely confident moving forward. Our business model has met the tests of the last year and has demonstrated its inherent resiliency. We’re seeing the early signs of recovery and pent-up demand across our businesses, we have secured the additional liquidity we need to take advantage of imminent opportunities, and we have a demonstrated ability to complete accretive acquisitions that build our enterprise.”

EIC’s complete interim financial statements and management’s discussion and analysis for the three-month period ended March 31, 2021, can be found at www.ExchangeIncomeCorp.ca or at www.sedar.com.

Conference Call Notice

Management will hold a conference call to discuss its 2021 first-quarter financial results on Friday, May 14, 2021, at 8:30 a.m. ET. To join the conference call, dial 1-888-231-8191 or 647-427-7450. Please dial in 15 minutes prior to the call to secure a line. The conference call will be archived for replay until May 21, 2021, at midnight. To access the archived conference call, please dial 1-855-859-2056 or 416-849-0833 and enter the encore code 9371537.

A live audio webcast of the conference call will be available at www.ExchangeIncomeCorp.ca and www.newswire.ca. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast. An archived replay of the webcast will be available for 90 days.

This press release was prepared and distributed by EIC.