Millennium Aviation Inc. Press Release | July 25, 2014

Estimated reading time 2 minutes, 33 seconds.

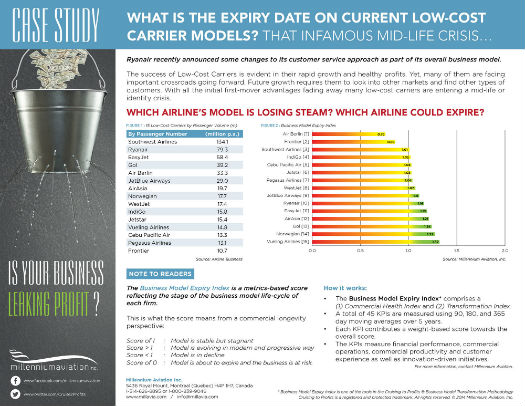

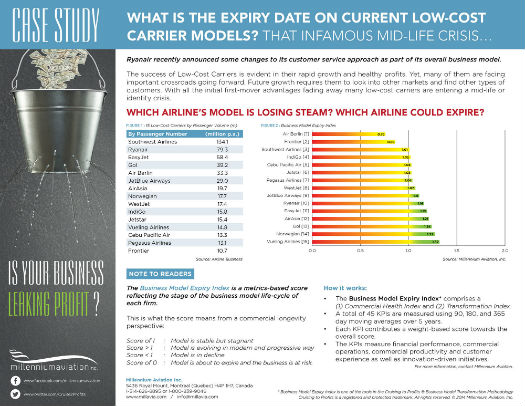

Millennium Aviation, Inc. has released its new quarterly report on the health and life cycles of airline business models, including an expiry index.

In its new report, Millennium Aviation provides a ranking of top low-cost and hybrid airlines in terms of how well they maintain or improve their business model. Airlines are not ranked in terms of a snapshot of their current profitability as reported in one quarter or fiscal year, but in terms of 45 specific underlying trends in their business model measured over five years. It shows whether the model is in good health and can continue to generate profits and retain its customers.

“Many CEOs and executive managers we have worked with still use balanced scorecards. A deeper look under the hood can reveal many blind spots that show the current business model is sliding towards sunset”, says Ricardo V. Pilon, CEO of Millennium Aviation. “An example is whether average fares per customer, ancillary revenues and overall profitability per customer have a positive trend against passenger volume growth. Other examples are how cash flow from new revenue sources increases variable or fixed costs, or are upsetting loyal customers and undermining repeat business, such as selling lounge access to non-frequent fliers”, he specifies. “Other examples are the disproportionate amount of fees and charges on redemption tickets, which also costs more and more points.”

Pilon adds: “We increasingly see multiple models within the main business model. It often creates conflict, confusion, delivery problems, customer retention issues and profit leakage.”

“Take for instance, WestJet. In absolute terms, it is still a profitable carrier. However, there are a number of factors that when combined tell us that the model is leaking. The case of Southwest is stronger and this explains why it is forced to explore other markets and take more risks by deviating from its traditional model. The worst case in the Top 15 is Air Berlin; it scores 0.76 which is far below the threshold of 1.0 (the ranking and explanation is provided separately)”.