Estimated reading time 6 minutes, 59 seconds.

Canada will struggle to retain its position as a leading player in the global aerospace market without a government-backed industrial policy.

That was the stark message form a trio of industry executives to the Canadian Aerospace Summit in mid-November as the sector embarks on Vision 2025, an exercise involving industry, federal and provincial governments, and other stakeholders to develop recommendations the Aerospace Industries Association of Canada (AIAC) hopes will lead to a long-term, fully-funded sector strategy.

“I think it is important we have a sound industrial policy in Canada,” said David Gossen, president of Halifax-based IMP Aerospace and Defence. “It’s clear every nation [that has an indigenous capability] is doing all they can to protect that industry. I think we need to follow that same principle.”

As an engineering and in-service support (ISS) provider to the Royal Canadian Air Force (RCAF), Gossen has seen the business model transform in recent years as OEMs have transitioned from long-term partners to fierce competitors for maintenance, repair and overhaul (MRO) work. He’s watched emerging markets start to create their own domestic support capabilities–in some cases after requesting IMP know-how. And he’s seen established aerospace nations erect barriers to protect their own ISS providers.

He’s also watched the boom and bust cycle of Canada’s shipbuilding industry on the East Coast and drawn lessons he fears aerospace is in danger of repeating. “We don’t [want to] spend 10 years trying to figure out how we rebuild [our] industry,” he cautioned.

Many of Gossen’s concerns were echoed by fellow panellists Dan Goldberg, president and chief executive officer of Ottawa-based Telesat, and Amandeep Kaler, chief executive officer of aerostructure manufacturer Avcorp Group.

Goldberg said the 50-year-old satellite communication services provider is being buffeted by similar dynamics as traditional players seek greater protection at home and emerging markets strive to gain entry. “Our industry is changing dramatically,” he said.

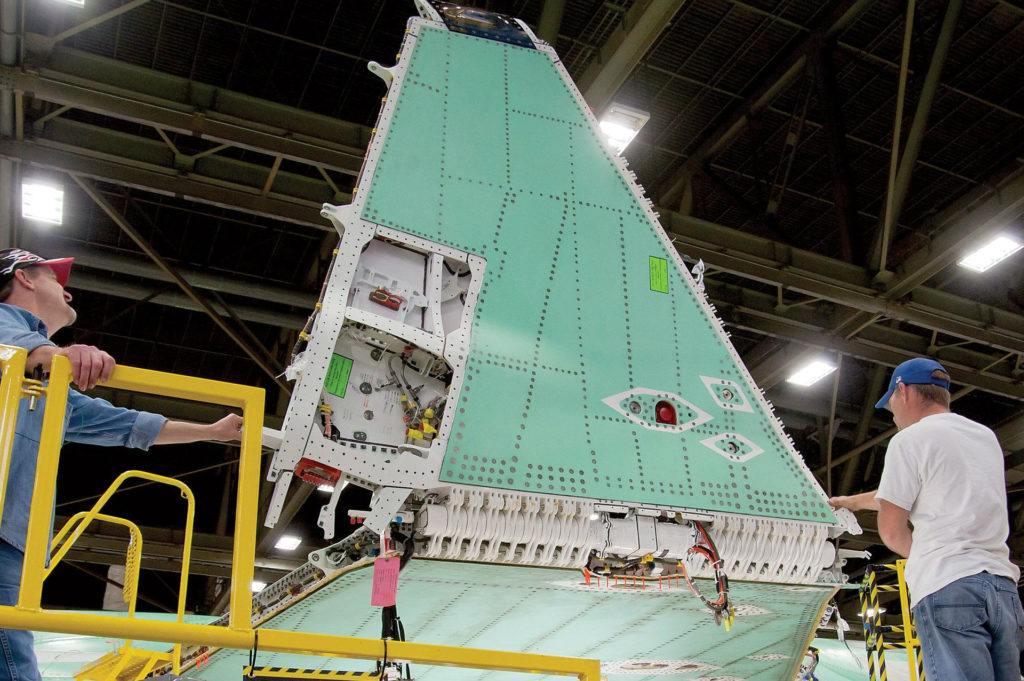

For manufacturers like Avcorp, a component and repair services supplier to international OEMs and airlines for over 16 years, “our business is being reshaped,” said Kaler, noting the growth of build-to-print suppliers in government-support markets.

“The race for best price is not going to slow down anytime soon,” he said. “You can let it happen or you can take the steps . . . to be the leading-edge of that by bringing your own capabilities and leveraging other technologies that are available to us in Canada.”

To survive, all three executives pointed to the need for expertise and intellectual property in niche capabilities. But they acknowledged government planning and support will be necessary if aerospace is going to capitalize on new technologies.

While Telesat, for example, would prefer its satellites to be manufactured and integrated by Canadian suppliers, many of which have the technical ability, “at the end of the day we are a for-profit company . . . and we are going to procure satellites from the group of companies that can give us the best overall value proposition,” said Goldberg.

If Canadian suppliers are to compete in the company’s project for a new constellation of low orbit satellites, they will have to make “meaningful investments,” which will require provincial and federal assistance, he acknowledged. “I can say their competitors outside of Canada are receiving that kind of support,” he said.

Goldberg flagged niche capabilities such as digital processing in space, phased array antenna technologies, and optical communications which several Canadian companies already provide.

“They need to evolve their technologies to deliver what we need, and that is going to be a big investment on their part,” he said.

Kaler and Gossen highlighted niche areas like robotics, automation, business aircraft, artificial intelligence as well as simulation and training systems and ISS, both of which were identified in a 2013 report by Tom Jenkins of Open Text, Canada First: Leveraging Defence Procurement Through Key Industrial Capabilities.

Though government departments have refined the list of key industrial capabilities since the report was published, the strategy to leverage them is still pending.

“Every segment will say we need to be supported. The reality is we can’t be everything; we need to pick those we’re good at and ensure we have good policies to support them,” said Gossen.

“We need a healthy debate within government and industry to identify what those capabilities are,” he added, alluding to the promise of Vision 2025, an exercise now underway and led by Jean Charest, a former Québec premier and federal cabinet minister.

“If I were a government policymaker, I’d start with what are we good at today and where these global markets are going, and then try and connect the dots between the two. And then I would start making some bets,” said Goldberg. “If the government doesn’t start leaning in on some of these policies, all of these capabilities will completely atrophy.”

In a controlled market such as defence, where governments often protect domestic manufacturers and build new capabilities, Gossen also argued for a similar approach to level the play field. Canadian suppliers need government help understanding where they can sell, he said, noting “a lot of markets are just closed to us.”

Playing the sovereignty card, he said Canadian companies “should have the ability to service Canada’s military equipment,” and suggested an industrial strategy could ensure “homefield is always protected.”

Government backed policy ..does that mean more from the LIBS ???