Estimated reading time 12 minutes, 2 seconds.

Domestic air travel will lead the recovery of the airline industry, which should reach pre-Covid levels by mid-2023, but international travel will only return to normal by 2026, according to Kevin Michaels, managing director of AeroDynamic Advisory.

“But it could be a bumpy ride as Covid outbreaks re-emerge, and one of the longer-term challenges is slower GDP growth of around 3.3 percent,” he said at the 8th edition of Aero Montreal’s International Aerospace Innovation Forum under the theme, “Journey to the Heart of Sustainable Air Mobility.” In addition, the Boeing 737 Max inventory of about 400 aircraft should be cleared out by 2025, he added.

Some of the current supply chain chaos stems from people spending more on goods than services, resulting in labor shortages. Microchips, critical to OEMs, face major bottlenecks along with forgings and castings — a problem for engine suppliers like Pratt & Whitney Canada, Michaels noted.

The business jet market is in good shape with low inventory, which is good news for Bombardier, noted Richard Aboulafia, also managing director at AeroDynamic. Defense spending is in recovery territory, too, which is more good news for Canadian companies.

Ultimately, the long-term goal of achieving zero emissions by 2050 is changing the whole dynamic of the aerospace industry, and while the sector only represents two percent of all greenhouse gasses (GHGs), other industries are more aggressive in reducing their carbon footprint, said Michaels.

“The net zero imperative will slow down long-term travel, and the projected five percent annual growth for the sector may be threatened unless we invest heavily in SAFs [sustainable aviation fuels].”

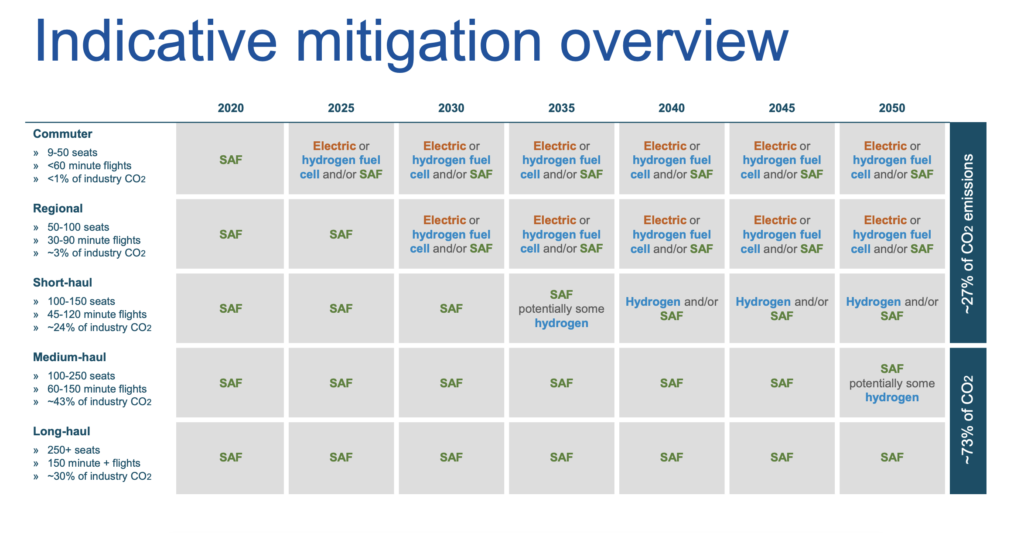

Engine OEMs must participate in multiple propulsion technologies, which could result in sector consolidation, explained Michaels. “Nearly everything will be transformed by the net zero imperative, which could benefit the turboprop industry. There is also a booming industry at airports that are striving for net zero emissions.”

The SAF market has made tremendous advances over the last few years with no less than seven different feedstocks being used by airlines. The next challenge is to ramp up production from millions to billions of gallons required in less than 10 years, noted Graham Warwick of Aviation Week Network, who was moderating a session entitled, “SAF: A Key Pillar to Decarbonization.”

In fact, forward purchases of SAF have gone from $7 billion pre-Covid to $25 billion today, according to Haldane Dodd, executive director of the Geneva-based Air Transport Action Group, a platform for commercial aviation to work together on long-term sustainability issues. Demand for SAF will likely reach 445 million metric tons by 2050, compared to less than five billion tons today.

“Teamwork is vital to meet the needs of the sector from the energy, finance, and government sectors,” added Dodd.

SAF is the quickest path to decarbonization, according to Jean Paquin, president and CEO of Montreal-based SAF producer, Consortium SAF+, which includes Airbus and Air Transat. Paquin noted that the aviation sector doesn’t have many options yet.

“By 2030, the industry will need 400 plants like ours to meet demand. The ecosystem needs to be large with many options and technologies, and we need strong government policies guiding the development of SAF.”

Industry must also source from local producers instead of importing SAF to incentivize use and cost, said Chrystal Healy, VP of corporate responsibility at Air Transat.

“Carbon offset programs for airline passengers have only two to three percent participation,” she said. “We need to educate customers if we want them to pay for offsets.”

There is little financing for the pre-program development stage for things like engineering and design of an SAF plant, which has an average cost of $50 million, according to John May, managing director of project financing company Hamilton-Clark Sustainable Capital.

“Bill Gates Venture and Amazon, among others, have ESG [Environmental, Social and Governance] funds. The challenge for us is to seek ESG investors such as giant corporations, even possibly oil companies and private equity. There are carbon credits available, but there is still reticence about risk.”

Space for eVTOLs

The electric vertical take-off and landing (eVTOL) aircraft market will grow fastest in places where certification adoption and public acceptance is strongest, noted Nimrod Golan-Yanay, CEO of eVTOL maker Urban Aeronautics. The main markets will be city-to-city and inter-city for airport shuttles and emergency medical services.

“It will be like Uber where you order a flight from your phone. It will be quite the journey for pilots, but more so for passengers.”

Martin Peryea, CEO of Jaunt Air Mobility, a Dallas-based aircraft manufacturer, said it will take time to ramp up production and get certification for air taxis, and demand will initially be stronger than supply.

“Our aircraft are designed for commuters,” he said. “If we can replace one car, it will speed up traffic and reduce GHGs. But labor shortage is a problem in most cities, which means we need to bring in people from further away.”

Jaunt Air Mobility has been working with CAE to train new pilots, including high school graduates, and Peryea expects some existing helicopter pilots will migrate to eVTOLs.

Every city around the world is at various stages in terms of air taxis, which offer time savings and reliability, said David Rottblatt, VP of business development at Eve Air Mobility — an independent company in Brazil founded by Embraer to develop products for the urban air mobility market. The estimated market for air taxis is a minimum of $750 billion, he added.

“The rate of adoption will depend on how cities can show the value proposition, which is different in Dallas than in Montreal.”

The sector could grow by simply using existing infrastructure at the more than 5,000 airfields around the U.S., as well as by building nodes, and tapping into existing helicopter procedures. The sector could also repurpose existing infrastructure such as shopping malls.

What about regional air mobility?

Some industry experts think the regional air mobility market is in decline. One way to bring it back is by lowering operating costs, Mark Moore, CEO of Whisper Jet maker Whisper Aero, said during a session entitled, “The Electrification of Regional Air Mobility.”

“The cost in a Beechcraft is between $1 to $2.50 per passenger mile, compared to 30 cents in an automobile and 20 cents in a commercial aircraft,” said Moore. “We can get people out of their cars by offering a lower cost, functionless experience. The market demand is strong and battery density is almost there. Our near-term goal is to get to a 250-nautical-mile range.

“It’s OK to be skeptical because electric propulsion is new and battery technology has constraints,” he added. “But the technology shift is real and is increasingly recognized as the best way for carbon reduction.”

According to Omer Bar-Yohay, co-founder of Eviation Aircraft, we will need a paradigm shift in cost reduction to develop the electric fixed-wing market.

“The next five years will be amazing,” he said. “Electric fixed-wing aircraft are here. A six- to nine-passenger model would be a nice way to start to make the public and regulators feel more comfortable.”

Bar-Yohay doesn’t think collaboration with the traditional aerospace industry is the way to go, noting it’s a completely different manufacturing method and there’s the possibility that a bigger company will take over your business.

Gregory Blatt, co-founder of Switzerland-based H55, which is collaborating with Pratt & Whitney Canada to develop a regional hybrid-electric propulsion flight demonstrator, noted that it’s easy to build a prototype, but harder to get it certified.