Estimated reading time 5 minutes, 21 seconds.

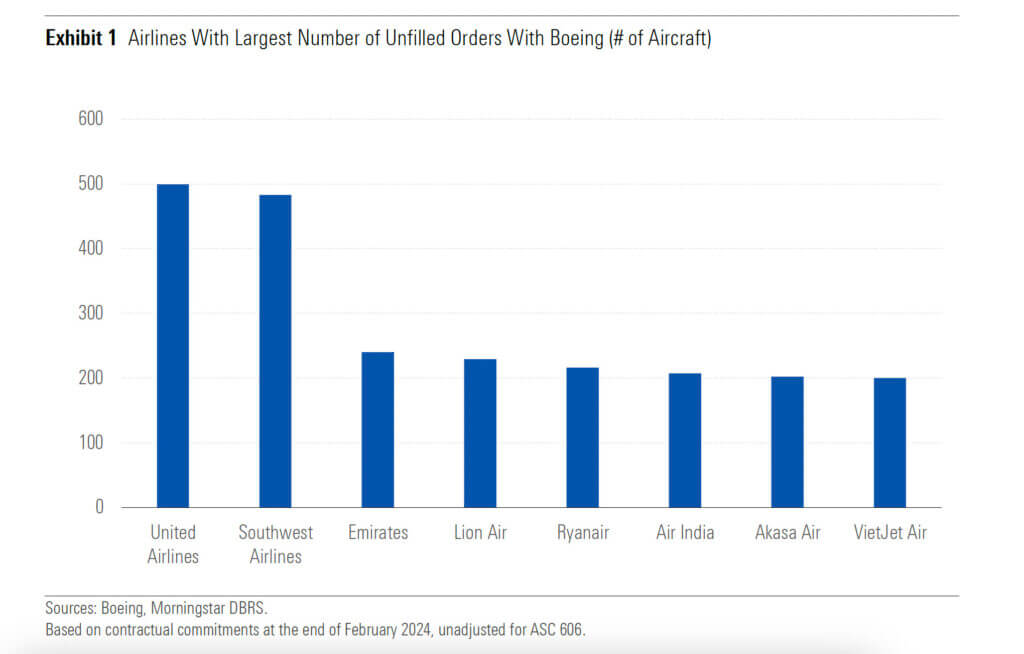

Aviation industry experts and organizations antiticpate that the airline sector will experience strong growth over the next few years in terms of both capacity and aircraft orders. In 2024, the International Air Transport Association (IATA) expects capacity to grow by nine per cent. Meanwhile, major airframe OEMs Boeing and Airbus have reported robust backlogs of 6,177 aircraft and 8,552 aircraft, respectively.

However, due to the recent safety concerns plaguing Boeing, the industry’s growth trajectory will face significant hurdles, according to a report from global credit rating agency Morningstar DBRS.

Recent safety incidents, such as the Alaska Airlines midair door plug blowout (January 2024), the LATAM Airlines Boeing 787 mid-air drop (March 2024), and the loss of an engine cowling on a Southwest Airlines 737-800 (April 2024), have placed Boeing back into the spotlight. These incidents follow the grounding of Boeing’s 737 Max fleet for nearly two years after fatal crashes in 2018 and 2019.

In response to the Alaska Airlines incident, the U.S. Federal Aviation Administration (FAA) temporarily grounded all Boeing 737 Max 9 aircraft, but the type has since been cleared to fly. The FAA’s findings did, however, prompt a pause in Boeing’s plans to ramp up 737 Max production rates until quality assurance measures are in place.

Making matters more complicated is the fact that Boeing’s CEO, Dave Calhoun, recently announced his retirement (set for the end of 2024), which prompted a reshuffling at the board and executive management levels.

In early March, the CEO of Boeing’s commercial airline division, Stan Deal, outlined the company’s planned safety improvements, which were to be presented to the FAA. Now that Boeing has shifted its focus toward safety issues, and 737 Max production rates cannot grow as planned, Morningstar says aircraft deliveries — which are already slower than in the past due to post-Covid supply chain issues — have been significantly affected.

“We previously expected the airline sector to continue its growth trajectory, with high-single-digit growth in 2024 despite a weaker macroeconomic environment. However, with Boeing’s recent issues as well as existing capacity constraints, that growth forecast may be optimistic,” said Rohit Kumar, assistant vice-president of corporate ratings, diversified industries at Morningstar DBRS.

“Certification of remaining Boeing 737 Max aircraft models could also become challenging,” Morningstar noted in its report.

Moreover, delays in Boeing aircraft deliveries could cause “operational challenges, as airline customers may have to revisit their already published schedules — most pressingly for summer 2024” — and they could be left in “an overstaffed situation,” the report states.

Carriers such as United Airlines, Southwest Airlines, Delta Air Lines, and Ryanair have already taken pre-emptive measures in response to delivery delays. According to Morningstar, United intends to offer pilots voluntary unpaid leave to mitigate staffing excess; Southwest has reduced its schedules and halted hiring; Delta has extended its anticipated deliveries of the non-yet-certified Max 10 to 2027; and Ryanair has slashed its summer 2024 schedule.

Further, delayed deliveries of new, more modern aircraft could jeopardize airlines’ decarbonization targets. (The airline sector has pledged to achieve net-zero carbon emissions by 2050 — a goal that is heavily reliant on fleet modernization.)

Despite these challenges, there’s a glimmer of hope for the air cargo sector, which has struggled post-pandemic due to “increases in the belly hold capacity of passenger aircraft” with grounded planes coming back online. Morningstar says Boeing’s delivery delays “could limit further expansion of commercial aircraft belly hold capacity and could also reduce the number of freighters being added to the capacity, including conversions.”

However, a significant uptick in profitability for the cargo sector remains contingent on improvements in air cargo demand, Morningstar reports.