Estimated reading time 6 minutes, 48 seconds.

JETNET iQ presented its “State of the Market Briefing” to reporters on the opening day of the 2022 NBAA convention and exhibition.

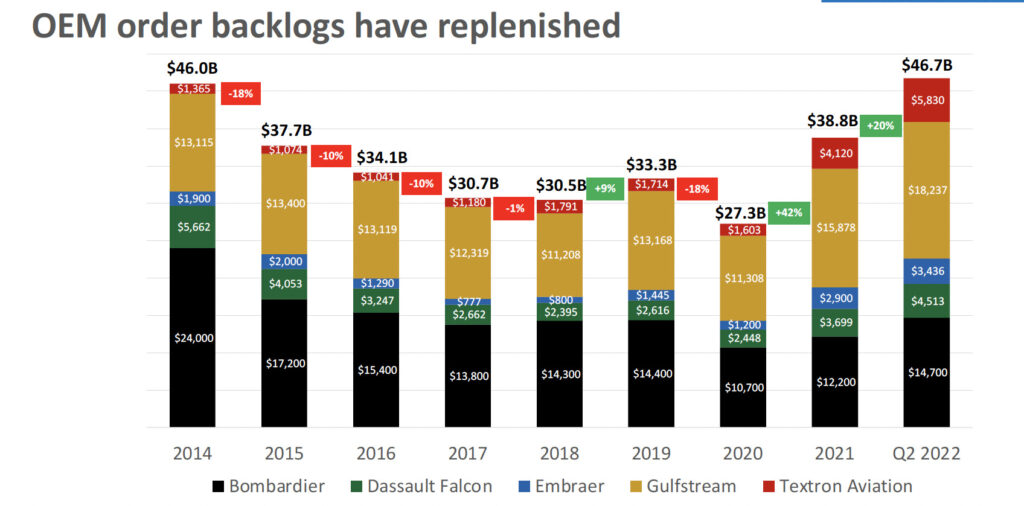

JETNET creator and director, Rolland Vincent, emphasized that airframe OEM backlogs have finally replenished, after 10 years of backlogs steadily declining. In Q2 2022, JETNET reported almost US$47 billion of backlog among the five major business aviation OEMs — Bombardier, Dassault, Embraer, Textron, and Gulfstream. This is up significantly from pre-pandemic, 2019 levels of $33.3 billion. Vincent noted that the firm is “expecting the numbers to go higher” as Q3 reports are due soon. However, Q4 is a “big delivery quarter,” he said, meaning backlogs will decline by the end of the year.

Book-to-bill ratios for these OEMs — orders coming in versus units being shipped — are sitting at around 2.0 to 2.5 currently, which is good for the manufacturers but not sustainable for industry, Vincent noted. (A 1.0 book-to-bill ratio is where orders and deliveries are matched.) However, Vincent expects that this will not last, thanks to robust backlogs.

“Right now, if you have access to money, you’re probably looking to say, ‘I don’t want to wait two-and-a-half years for my airplane,’” explained Vincent. “So, I think that’s naturally going to bring the demand quotient down. We’re going to see a softening of booking to billing.”

Interestingly, according to JETNET’s quarterly surveys of 23,000 owners and operators, just over 51 percent of respondents said there is a zero percent chance they will purchase a new aircraft in the next 12 months. There are a variety of reasons for this response, but 17.6 percent of respondents said they do not need additional aircraft right now.

Another potential factor that could deter owners/operators from purchasing a new aircraft, at least in Canada, is the new luxury tax that has been imposed on aircraft worth $100,000 or more. Vincent said JETNET is watching this issue, and believes that once “people start seeing jobs being impacted in Toronto and Montreal, in particular, that tune is going to change.”

While it appears that the majority of respondents are not interested in purchasing a new aircraft in the next 12 months, Vincent noted that almost 10 percent of owners/operators say they do plan to purchase a new aircraft in that timeframe.

“These are actually pretty good numbers,” he said.

The fact that business aviation has experienced higher demand since mid-2020 is also still relevant, and this is partially due to customers switching over from commercial airlines during the pandemic. When JETNET asked owners/operators what they think demand will be like from these new customers over the next five years, 58.2 percent said they believe demand will increase further.

As part of its forecast, JETNET is predicting that new business jet deliveries will increase to exceed 2019 levels beginning in 2023. Over the next decade, the firm estimates 8,400 new jet deliveries.

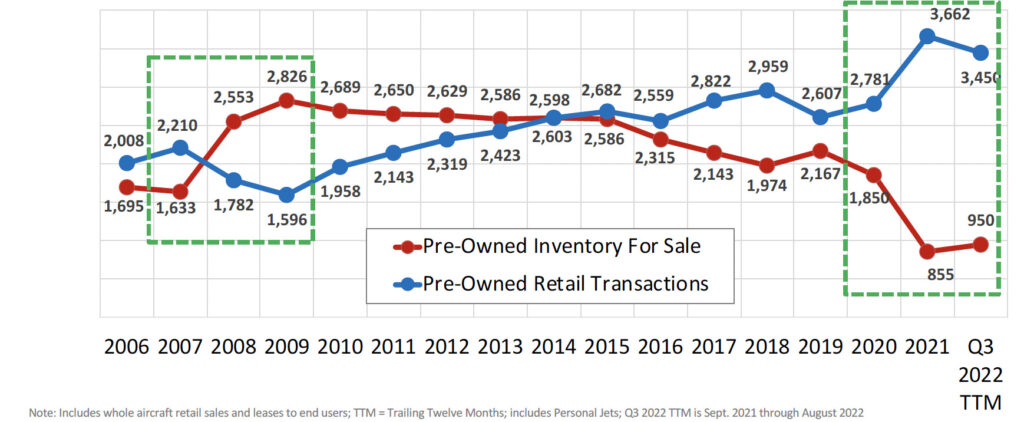

As for the pre-owned business jet market, JETNET reported that pre-owned inventory has begun to increase after record lows. Towards the end of 2021 and heading into 2022, the pre-owned market hit a record low with 3.2 percent net inventory of business jets for sale. That percentage translates to less than 750 bizjets on the market, said Paul Cardarelli, JETNET’s vice president of sales.

Today, pre-owned inventory is sitting at about four percent, said Cardarelli, which shows a slight increase. The primary segments that have seen recovery in terms of pre-owned inventory are personal jets and very light jets.

JETNET’s latest research shows around 950 pre-owned aircraft for sale currently, versus 3,450 pre-owned retail transactions. This is completely opposite from trends over a decade ago in 2009, when there were 2,826 pre-owned aircraft for sale versus 1,596 pre-owned retail transactions. Cardarelli noted that at that time, inventory was measured as high as 18.6 percent.

“Nearly one in every five business jets on a ramp was for sale,” he said.

JETNET believes pre-owned bizjet sales peaked in 2021. However, the firm is still expecting the fourth quarter of 2022 to be a robust one. According to JETNET’s quarterly surveys, pre-owned aircraft purchase probability over the next 12 months is also slightly higher than new aircraft purchase probability, which Vincent said is typically the case. Around 15 percent of respondents said they are thinking of purchasing a pre-owned aircraft in the next 12 months.

Overall, Vincent believes the numbers in JETNET’s latest report are indicators that the outlook for 2023 is strong.