Estimated reading time 6 minutes, 40 seconds.

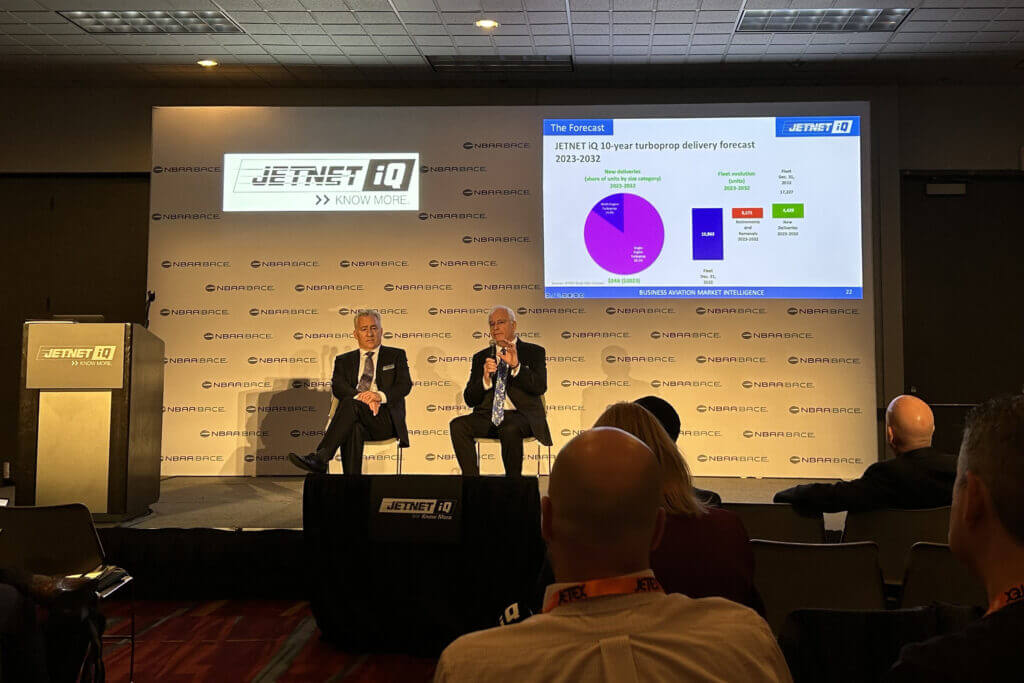

On the opening day of NBAA-BACE 2023, JETNET iQ — which provides insights and analytics for the business aviation market — presented its “State of the Market Briefing” to attendees.

The company’s creator and director, Rolland Vincent, noted that the last few years have been “a very good time for business aviation . . . [with] tremendous demand for our services,” but he acknowledged that the industry has “not been able to supply that demand.”

While those are good problems to have, “they are problems,” he said.

Of course, the industry has yet to resolve supply chain challenges that are partially due to the Russia-Ukraine war that began in early 2022, and could be exacerbated by troubling situations in the Middle East. Vincent said rebuilding the talent pipeline is a key to the supply chain solution.

“Bringing young, diverse people into this industry… bringing more people into this industry is going to help us with supply chain, quality, [and] all kinds of things,” said Vincent. “So we’re really focusing on talent and how to excite young people, in particular,” to join the industry, and how to ensure that those who are already in the industry stay in it.

Improving the business aviation industry’s image — particularly when it comes to sustainability — is an important step in attracting younger generations, Vincent noted. In fact, during NBAA-BACE, several industry leaders launched an advocacy campaign to dispel misconceptions about business aviation and emphasize the industry’s commitment to achieving net-zero carbon emissions. (Noteworthy is the fact that owner/operators have shown a 70 per cent increase in consideration of sustainable aviation fuel when compared to 2019, according to data from JETNET’s quarterly surveys.)

Despite some of these challenges, “the good news is the aircraft owner community is feeling quite optimistic,” said Vincent.

According to the quarterly surveys, industry sentiment (or the mood of the market) has been steadily declining since the fourth quarter of 2021 — particularly in North America. However, in the recent Q3 2023 survey, the mood among the owner/operator community in the U.S. and Canada began to show signs of improvement.

Moreover, JETNET’s outlook for the end of the year (in terms of aircraft deliveries) is “generally good.” However, the numbers are likely to be lower than the company forecasted due to the fact that the Gulfstream G700 is not likely to receive certification before year’s end.

JETNET’s 10-year bizjet delivery forecast, which is updated every 90 days, currently shows 8,685 new deliveries through 2032 (worth US$268 billion) — comprised mainly of light jets and large ultra-long-range jets. The 10-year turboprop delivery forecast shows 4,429 new deliveries, comprised mainly of single-engine turboprops.

“We’re very bullish on this market, especially in the latter period of the forecast,” stated Vincent.

In its State of the Market Briefing during last year’s NBAA, JETNET predicted that OEM book-to-bill ratios (orders coming in versus units being shipped) were likely to slip from their 2.0 to 2.5 range. (Anything above 1.0 means OEMs are building backlog.)

According to Vincent, “We’re in this position where OEMs are starting to see the return to closer to 1.0.” Although, he acknowledged that book-to-bill ratios could spike if OEMs announce large fleet orders during NBAA-BACE.

JETNET’s data show that Embraer’s book-to-bill ratio in Q3 2023 is noticeably higher than the other four major OEMs — Bombardier, Textron, Gulfstream, and Dassault — hovering around the 2.0 mark, following a dip in 2022. That is not reflective, however, of some of Embraer’s recently announced orders, so it will continue to trend upwards.

“If this sustains, [Embraer is] going to need new production and assembly facilities,” said Vincent.

In the first half of 2023, backlogs across the five major OEMs sat at a total of $50.3 billion. This is up from $49.1 billion in 2022 and $38.8 billion in 2021.

When compared to the pre-pandemic period, “Textron and Embraer, in particular, have had tremendous improvements in backlog positions — going from three months of factory orders to a year-and-a-half to two years,” noted Vincent.

When JETNET’s presentation concluded, Vincent told attendees that, overall, the key takeaway is that business aviation has “a lot of work to do — a lot of good work,” especially in terms of sustainability and rebuilding the talent pipeline.