Estimated reading time 14 minutes, 58 seconds.

The coronavirus disease (COVID-19) outbreak is of considerable concern to the aviation industry and poses specific challenges for the airport business, in terms of traffic, revenues, connectivity and slot usage requirements.

This advisory bulletin is addressed to ACI members and presents a status update on the estimated impact of the COVID-19. This follows the Advisory Bulletin: Transmission of Communicable Diseases issued by ACI World in January which was intended as guidance for airports and national authorities to use to protect against communicable diseases that might pose a serious risk to public health.

Airport operators remain first and foremost concerned with protecting the health and welfare of travellers, their staff and the public, and reducing opportunities for transmission of communicable diseases.

The loss of passenger and cargo traffic, the loss of revenues — which impact airports’ ability to recover their capital and operating costs — and the loss of connectivity due to flights cancellations are all creating a unique set of threats to airport operations and continuous airport development.

This current status update is based on data in ACI databases and on scheduled capacity, extracted in early March 2020, soon after major clusters of coronavirus incidence were found in countries outside Eastern Asia, such as Italy and Iran. The estimations for the impacts of the current crisis rely on a best-case scenario, which is that the brunt of its effects will be concentrated in the first quarter of 2020.

Impact on passenger traffic

Passenger traffic continued to post positive annual growth rates in 2019. Based on preliminary data, traffic exceeded 9.1 billion passengers in 2019, representing +3.4 per cent growth in total passenger traffic year-over-year. While the figure marked a positive end to 2019 after a challenging year for the air transport industry, it comes as the effects of the ongoing COVID-19 outbreak start to appear in traffic results in 2020.

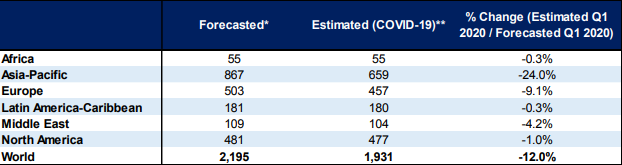

The impact on COVID-19 is currently pronounced. At the global level, ACI World estimates that airport traffic volume for the first quarter of 2020 will be down at least 12 percentage points compared to what ACI previously estimated in its pre-COVID-19 World Airport Traffic Forecasts for the first quarter of 2020. It is clear that Asia-Pacific is the most impacted region, with passenger traffic volumes down 24 percentage points as compared to the forecasted traffic levels (with no COVID) for the first quarter of 2020.

Within Asia-Pacific, Hong Kong SAR, mainland China and Republic of Korea remain at the center of the effects with sizable losses in traffic volumes.

In parallel with the ongoing crisis in Asia-Pacific, there is a sharp spike in the number of COVID-19 cases in several countries in Europe and in the Middle East, and North America. As such these regions are also expected to be significantly impacted by traffic downfall. Considering that the outbreak is more recent in these regions, it is expected that travellers and airlines will adjust their plans and seat offers in the coming days or week. Impacts on travel will likely be felt into the second quarter of 2020 and will require further monitoring and analysis.

In addition to the official bans and restrictions on travel, sharply reduced business and leisure travel, there is a general travel confidence issue causing consumers to pull demand forward, events being cancelled, and businesses reducing their normal activity.

All other regions are also being impacted by the COVID-19. Preliminary data indicates regional traffic in North America, Latin America-Caribbean, and Africa has also been negatively impacted. Additional impacts will be seen in the second quarter of 2020. (See Table 1).

Shortfall in airport revenues

Airports are two-sided businesses, engaging in a commercial relationship with both airlines and passengers. They receive their revenues from two primary sources: aeronautical activities and non-aeronautical activities.

Both revenue streams are vital to support the sustainable development of airports. They are used to recover the large capital costs incurred by airports–and these are significant as the airport industry is highly asset-intensive–as well as operating expenses and especially personnel expenses.

The impact of COVID-19 is challenging airports on both of those revenue channels. The shortfall in the number of passengers and the cancellation of flights leads to reduced revenues from airport charges (landing charge and parking charges paid by airlines for instance, and passenger service charges and security charges paid by passengers). While aeronautical revenues are being challenged, the cost base for airport charges remains unchanged as airports can neither close nor relocate their terminals during the outbreak.

Non-aeronautical sources of revenue usually provide diversification of airport income streams, but they also serve as an additional cushion during economic downturns. With the COVID-19 impacting, to a large extent, Chinese passengers, it creates a wider effect for airports worldwide as passenger traffic from Eastern Asia tends to generate comparatively high revenue for retail concessions and other non-aeronautical services.

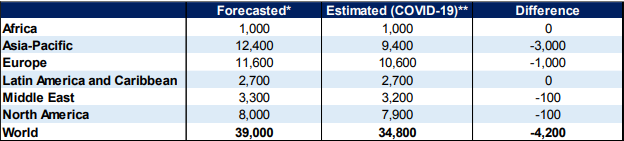

ACI currently forecasted that, prior to the COVID-19 outbreak, global airport revenues for the first quarter of 2020 would reach close to $39 billion (all figures in U.S. Dollars). Based on traffic trends under COVID-19 and constant unit revenues, ACI now estimates a loss of revenues of at least $4.2 billion. This is approximately equal to the total annual revenues of two major European or Asian hubs combined.

Most of the loss in revenues is expected to occur in the Asia-Pacific region with a difference of $3 billion in the projected revenue. Europe is the second most-impacted region with an estimated loss of $1 billion in the first quarter of 2020, while other regions will see the impact of the loss of East Asia passengers in their revenues (see Table 2).

versus estimated (COVID-19) (million USD). ACI Image

In this context, airports must continue to be able to leverage both aeronautical and nonaeronautical revenues from their users and end-users. Alleviating the collection of airport charges from airlines and passengers is not conceivable. Airports rely heavily on airport charges to continue to fund their operating expenditures among which personnel expenses continue to represent the largest component, accounting for 33.9 per cent of all operating expenses.

Airports must also continue to meet their capital expenses obligations as they remain characterized by predominantly high fixed costs necessary for maintaining and operating the infrastructure components of the airport, such as runways, taxiways, aprons, parking stands and terminal buildings.

Requests to alleviate or discount airport charges must consider the high fixed costs that airports are already exposed to independently of a traffic downturn. Airport operators find themselves under intense pressure especially during a traffic decline. Airport revenues must be sufficiently protected to ensure safe and sustainable operations and development of airport infrastructure. Infrastructure costs for airports are largely fixed.

Slot usage requirements and airport connectivity

The COVID-19 outbreak has resulted in flight cancellations in the most impacted regions and has created challenges for airport connectivity worldwide.

Regulatory provisions on force majeure and the justified non-utilization of slots on specific routes, such as those to China, are embedded in several airport slot regulations. It allows airlines to already claim justified non-utilization of slots on cancelled flights to/from impacted countries in Asia so that their slots at congested airports are protected. However, such provisions do not cover situations of heavily reduced airline load factors due to exceptional circumstances such as COVID-19.

Consequently, ACI World, in a strategic alignment with the five ACI Regions, is urging a proportionate slot allocation response to COVID-19 that will preserve global airport connectivity. However, a global suspension of slot rules worldwide may jeopardize the ability of countries to stay connected which will in turn negatively affect economies.

ACI World fully recognizes the public health crisis, and further believes that any measure to address the current circumstances requires a balanced approach. The need for people to continue necessary travel needs to be taken into consideration without obliging airlines to fly empty aircraft which would be unwarranted and unsustainable.

ACI World favours an evidence-based market-by-market review. An evidence-based review would examine infection rates, load factors, forward booking forecasts, and the impact on the environment of continuing certain services. ACI World further favours that airlines not using their allocated slots relinquish them to slot coordinators within 24 hours of the related flights being taken out of booking systems and inform airport operators accordingly.

Depending on local circumstances, a relaxation to a lower threshold as a first step may be considered. This could be the case for markets where airlines are trimming capacity to reflect the lower demand impact experienced on routes not as directly impacted. In markets that are severely impacted by the COVID-19 outbreak and subject to large travel bans, a suspension of the 80/20 rule may be considered for a limited period, in consultation with airport operators, airlines and slot coordinators.

To this end, ACI World is calling for strengthened cooperation with the International Air Transport Association (IATA) and Worldwide Airport Slot Coordinators Group (WWACG) to respond commensurately to the risk posed by the COVID-19.

Conclusion: preserving the financial sustainability and connectivity of airports

The sudden shock represented by the COVID-19 outbreak is impacting passenger and cargo traffic worldwide and with a marked effect in Asia-Pacific. It induces a period of downward pressure on airport revenues, which are nonetheless essential to recover the capital and operating costs incurred by airports.

In the short-term, it creates strong pressure on airport operating expenses. As such, airports must continue to be able to levy both aeronautical and non-aeronautical revenues from their users and end-users, making requests to alleviating the collection of airport charges ill-advised.

Similarly, ACI World, in a strategic alignment with the five ACI Regions, is urging a proportionate slot allocation response to COVID-19 that will preserve global airport connectivity and favours a market-by-market review which is evidence based when it comes to assessing slot usage requirements.

As the situation continues to unravel quickly, and cognizant that the above analyses are based on data from ACI databases and on scheduled capacity extracted in early March 2020, ACI will continue to closely monitor the situation and adjust its advisory accordingly.

The airport industry recognizes that all stakeholders of the aviation ecosystem are equally impacted by the COVID-19 outbreak, and as such favours a strengthened cooperation between airports, airlines, and regulatory authorities.

Methodological Note

ACI World estimated the impact of the coronavirus disease 2019 (COVID-19) on the airport industry in terms of potential losses in traffic and revenues based primarily on two key data elements: estimated traffic considering the latest COVID-19 statistics and unit revenues derived from the Airport Key Performance Indicators 2020, as total airport revenues are largely a function of traffic, while unit revenues have remained stable in the recent years.

Traffic estimates for Q1 2020 were generated using the scheduled seat capacity obtained from the Official Airline Guide (OAG), as there is a strong correlation between scheduled seat capacity and total passenger traffic volumes.

The impact has been measured as a difference between the “pre-COVID-19 scenario” under the previously published traffic forecast figures for the first quarter of 2020 as well as year-end 2020 and the “COVID-19 scenario” with estimated traffic and revenues for the first quarter of 2020 and year-end 2020, on a country-by-country basis, and then aggregated into regional figures.

The first quarter 2020 traffic, and hence the revenue figures, take into account the seasonality patterns for the year 2019 calculated on a country-level basis.

In cases where monthly traffic data coverage was limited for a particular country, regional seasonality indicators were applied to estimate its traffic share in the first quarter of 2020.

The World Airport Traffic Forecasts (WATF) 2019-2040 was taken as a baseline for simulating the “business as usual scenario” and hence a least common denominator in understanding all potential discrepancies in traffic and airport revenues as a consequence of COVID-19.

The impact of COVID-19 on passenger traffic for year-end 2020 was estimated under three scenarios:

- Optimistic scenario based on the assumption that the impact of COVID-19 will be limited to the first quarter of 2020;

- Pessimistic scenario based on the assumption that the impact will continue through the second quarter of 2020, and

- Median scenario based on the median values between the optimistic and pessimistic scenarios.

The revenue per passenger indicators (unit revenues) were calculated for airports on a country-by-country basis. In cases where the indicators were unavailable, regional indicators were applied as an approximation for the country-level indicators.

Considering limited information on the impact of disease outbreaks on unit revenues, airport revenues were estimated under an assumption of constant unit revenues. As such, the estimates represent an optimistic scenario, as it is highly likely that unit revenues will be adversely impacted, both on the aeronautical and non-aeronautical sides of the business.

The main limitation of such methodology is that is does not consider additional factors affecting traffic volumes in parallel with COVID-19, such as economic downturns. As such, a fraction of the traffic and revenues losses can be accounted for factors either completely unrelated to COVID-19 or induced by COVID-19.