Estimated reading time 7 minutes, 29 seconds.

The Boeing Company recorded first quarter revenue of $16.6 billion, GAAP loss per share of ($0.56) and core loss per share (non-GAAP) of ($1.13) .

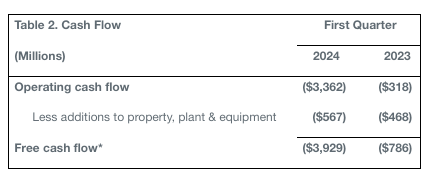

Boeing reported operating cash flow of ($3.4) billion and free cash flow of ($3.9) billion (non-GAAP). Results primarily reflect lower commercial delivery volume.

“Our first quarter results reflect the immediate actions we’ve taken to slow down 737 production to drive improvements in quality,” said Dave Calhoun, Boeing president and CEO. “We will take the time necessary to strengthen our quality and safety management systems and this work will position us for a stronger and more stable future.”

Operating cash flow was ($3.4) billion in the quarter reflecting lower commercial deliveries, as well as unfavorable timing of receipts and expenditures.

| Table 3. Cash, Marketable Securities and Debt Balances | Quarter End | |||||||||||||

| (Billions) | Q1 24 | Q4 23 | ||||||||||||

| Cash | $6.9 | $12.7 | ||||||||||||

| Marketable securities1 | $0.6 | $3.3 | ||||||||||||

| Total | $7.5 | $16.0 | ||||||||||||

| Consolidated debt | $47.9 | $52.3 | ||||||||||||

| 1 Marketable securities consist primarily of time deposits due within one year classified as “short-term investments.” | ||||||||||||||

Cash and investments in marketable securities totaled $7.5 billion, compared to $16 billion at the beginning of the quarter reflecting debt repayment and free cash flow usage in the quarter (Table 3).

Debt was $47.9 billion, down from $52.3 billion at the beginning of the quarter due to the pay down of maturing debt. The company has access to credit facilities of $10.0 billion, which remain undrawn.

Total company backlog at quarter end was $529 billion.

Segment Results

Commercial Airplanes

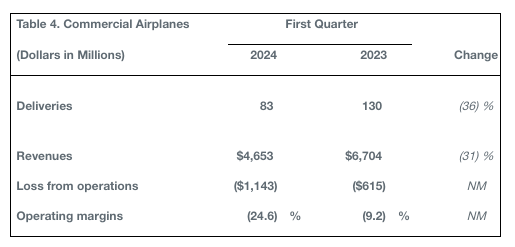

Commercial Airplanes first quarter revenue of $4.7 billion and operating margin of (24.6) per cent primarily reflect lower 737 deliveries and 737-9 grounding customer considerations (Table 4).

During the quarter, the 737 program slowed production below 38 per month to incorporate improvements to its quality management system and reduce traveled work within its factory and supply chain. In addition, Commercial Airplanes is implementing a comprehensive action plan to address feedback from the FAA audit of 737 production.

Commercial Airplanes booked 125 net orders, including 85 737-10 airplanes for American Airlines and 28 777X airplanes for customers including Ethiopian Airlines. Commercial Airplanes delivered 83 airplanes during the quarter and backlog included over 5,600 airplanes valued at $448 billion.

Defense, Space & Security

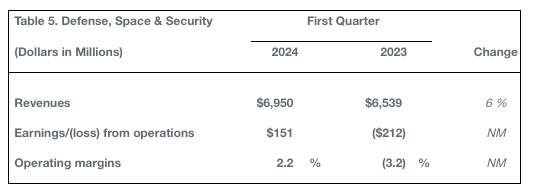

Defense, Space & Security first quarter revenue was $7 billion. First quarter operating margin increased to 2.2 percent, primarily driven by higher volume and improved performance. Results also reflect $222 million of losses on certain fixed-price development programs.

During the quarter, Defense, Space & Security captured awards for 17 P-8A Poseidon aircraft for the Royal Canadian Air Force and German Navy, secured the final new-build production contract from the U.S. Navy for 17 F/A-18 Super Hornets, and was awarded an MQ-25 cost-type contract modification from the U.S. Navy including two additional test aircraft. Backlog at Defense, Space & Security was $61 billion, of which 31 per cent represents orders from customers outside the U.S.

Global Services

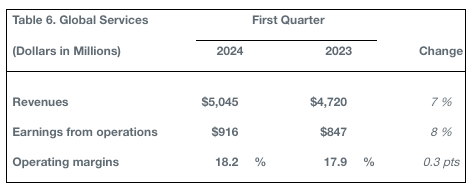

Global Services first quarter revenue of $5.0 billion and operating margin of 18.2 per cent reflect higher commercial volume and favorable mix.

During the quarter, Global Services opened a maintenance facility in Jacksonville, Florida, supporting military customers and the U.S. Navy exercised options on a P-8 sustainment modification contract.

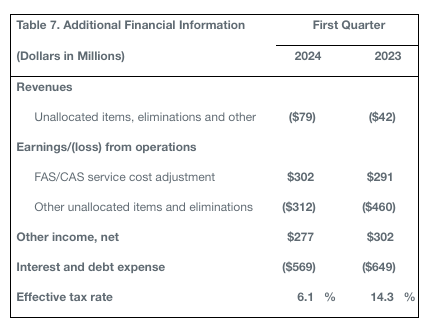

Additional Financial Information

Other unallocated items and eliminations primarily reflects timing of allocations.

This press release was prepared and distributed by Boeing.