Estimated reading time 18 minutes, 32 seconds.

Chorus Aviation Inc. (‘Chorus’) (TSX: CHR) on Aug. 4 announced second quarter 2022 financial results.

“With our first quarter since the Falko acquisition now complete, I am happy to see Falko delivering the expected results. In addition, the integration of Falko is progressing very well as both organizations share similar leadership styles and cultures.

We have already begun to see the Falko asset management platform demonstrate its contribution to the diversification and flexibility of our business. In June we announced the addition of 35 turboprop aircraft in a servicing capacity on behalf of a syndicate of banks further expanding our asset management business and demonstrating Falko’s ability to broaden its customer base,” stated Joe Randell, President and Chief Executive Officer, Chorus.

Mr. Randell continued: “The Falko acquisition has made Chorus a market leading regional aircraft asset manager and the world’s largest aircraft lessor focused solely on the regional aircraft leasing space thereby significantly advancing our growth and diversification strategy. We now expect to derive approximately 50% of our 2022 annual Adjusted EBITDA from the Regional Aviation Leasing (RAL) segment of our business. We have begun the process of launching Falko’s next fund and are pleased with the early response. We will continue to transition our focus to an asset light model and will opportunistically explore asset sales, where appropriate, to create additional shareholder value through paying down debt and generating incremental cash flows.”

“In the second quarter we recorded a $45.6 million provision related to anticipated aircraft repossessions and lease restructurings. All our other customers are operating in compliance with lease agreements. This provision does not impact our longer-term outlook for the business,” added Mr. Randell.

“I sincerely thank the Chorus group of employees for all their hard work and dedication, and in particular our frontline employees, for their continued focus on the safety and well-being of passengers in what has been a challenging environment. Our Jazz operation continues to ramp up, and Voyageur’s parts provisioning and sales continue to hit new milestones as larger contracts won in 2021 progress as planned. We remain optimistic that these trends will continue to build momentum and we are very well positioned to execute on new growth opportunities that will deliver positive returns to our shareholders, fund investors, customers, and employees,” Mr. Randell concluded.

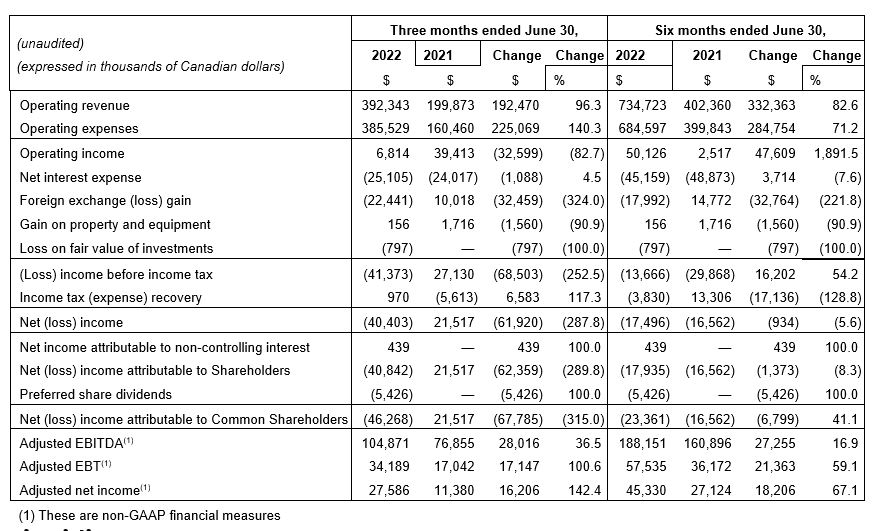

Second Quarter Summary

In the second quarter of 2022, Chorus reported Adjusted EBITDA of $104.9 million, an increase of $28.0 million over the second quarter of 2021.

The RAL segment’s Adjusted EBITDA increased by $25.4 million due to the inclusion of two months of earnings from the Falko Business as well as increased lease revenue from re-leased aircraft in CACIL’s aircraft portfolio.

The RAS segment’s Adjusted EBITDA increased by $2.6 million. Second quarter results were impacted by:

- an increase in other revenue due to an increase in parts sales and contract flying partially offset by a decrease in third-party MRO activity;

- an increase in capitalization of major maintenance overhauls on owned aircraft of $3.2 million; and

- an increase in aircraft leasing revenue under the CPA of $1.3 million primarily due to a higher US dollar exchange rate; offset by

- an increase in general administrative expenses attributable to increased operations.

Adjusted net income was $27.6 million for the quarter, an increase of $16.2 million over the second quarter of 2021 due to:

- a $28.0 million increase in Adjusted EBITDA as previously described; and

- a decrease of $1.9 million primarily due to unrealized foreign exchange changes on working capital; partially offset by

- an increase in depreciation expense of $9.3 million primarily attributable to the Falko Business;

- an increase of $0.9 million in income tax expense on adjusted items;

- a decrease in gain on property and equipment of $1.6 million;

- an increase in net interest costs of $1.1 million primarily related to interest on long-term debt assumed as part of the Falko Acquisition and interest on the Series B Debentures and Series C Debentures partially offset by the repayment of certain aircraft financings and the partial redemption of the 6.00% Debentures; and

- a loss on fair value of investments of $0.8 million.

Net loss increased $61.9 million over the second quarter of 2021 due to:

- an increase in impairment provision of $20.5 million;

- an increase in net unrealized foreign exchange losses primarily on long-term debt of $34.3 million;

- a restructuring expected credit loss provision of $10.4 million;

- an increase in lease repossession costs of $12.0 million;

- strategic advisory fees related to the Falko Acquisition of $5.7 million; and

- an increase in employee separation program costs of $1.7 million; partially offset by

- the previously noted increase in Adjusted net income of $16.2 million; and

- an increase in income tax recoveries on adjusted items of $7.5 million.

Year-to-Date Summary

Chorus reported Adjusted EBITDA of $188.2 million for 2022, an increase of $27.3 million over the same prior year period.

The RAL segment’s Adjusted EBITDA increased by $28.3 million primarily due to the inclusion of two months of earnings related to the Falko Business, the recognition of the expected recovery of Chorus’ claim in the Aeromexico bankruptcy and increased lease revenue from re-leased aircraft partially in CACIL’s aircraft portfolio.

The RAS segment’s Adjusted EBITDA decreased by $1.0 million due to:

- an increase in general administrative expenses attributable to increased operations; and

- an increase in stock-based compensation of $4.4 million due to a decrease in the Common Share price inclusive of the change in fair value of the Total Return Swap; partially offset by

- an increase in capitalization of major maintenance overhauls on owned aircraft of $4.6 million;

- an increase in other revenue due to an increase in parts sales and contract flying partially offset by third-party MRO activity; and

- an increase in aircraft leasing revenue under the CPA of $1.6 million primarily due to a higher US dollar exchange rate.

Adjusted net income of $45.3 million an increase of $18.2 million over 2021 due to:

- a $27.3 million increase in Adjusted EBITDA as previously described;

- a decrease in net interest costs of $3.7 million primarily related to the repayment of certain aircraft financing and the partial redemption of the 6.00% Debentures partially offset by interest on long-term debt assumed as part of the Falko Acquisition and interest on the Series B Debentures and Series C Debentures; and

- a decrease of $0.9 million in realized foreign exchange losses and increased unrealized foreign exchange gains on working capital; partially offset by

- an increase in depreciation expense of $8.2 million primarily attributable to the Falko Business;

- a $3.2 million increase in income tax expense on adjusted items;

- a decrease in gain on property and equipment of $1.6 million; and

- a loss on fair value of investments of $0.8 million.

Net loss of $17.5 million, an increase of $0.9 million over the prior period due to:

- an increase in impairment provisions of $20.5 million in the RAL segment;

- a change in net unrealized foreign exchange primarily on long-term debt of $33.7 million;

- an increase in lease repossession costs of $11.6 million;

- an increase in restructuring credit loss provision of $10.4 million;

- a decrease in income tax recoveries on adjusted items of $14.0 million;

- strategic advisory fees related to the Falko Acquisition of $8.4 million; and

- an increase in employee separation program costs, exclusive of the cost attributable to the pilot early retirement program and signing bonuses of $1.2 million; offset by

- the previously noted increase in Adjusted net income of $18.2 million; and

- one-time restructuring costs of $80.7 million in 2021 related to the 2021 CPA Amendments.

Consolidated Financial Analysis

This section provides detailed information and analysis about Chorus’ performance for the three and six months ended June 30, 2022 compared to the three and six months ended June 30, 2021. It focuses on Chorus’ consolidated operating results and provides financial information for Chorus’ operating segments.

Liquidity

As of June 30, 2022, Chorus’ liquidity was $148.6 million including cash of $70.7 million and $77.9 million of available room on its Operating Credit Facility and Unsecured Revolving Operating Credit Facility. Liquidity decreased from the first quarter of 2022 by $51.1 million primarily due to payment for the Falko Acquisition, offset partially by strong cash flows from operations.

In addition, in July 2022 Chorus securitized the beneficial interests in five aircraft trusts and as a result, was able to remove restrictions on US $27.6 million of cash that had been held as security for a loan.

Chorus anticipates having total liquidity in excess of $100.0 million for the remainder of 2022. This will provide it with sufficient liquidity to fund ongoing operations, planned capital expenditures and principal and interest payments related to long-term borrowings

Outlook

(See cautionary statement regarding forward-looking information below)

Chorus completed the Falko Acquisition in the second quarter of 2022. This transformative transaction creates new opportunities for growth, through increased access to growth capital and a differentiated business model to maximize returns on aircraft assets.

Key Economic Assumptions:

- The forecast assumes the launch in the fourth quarter of 2022 of a new investment fund managed by Falko with (i) a minimum of US $500.0 million in capital commitments and (ii) management fees and economic terms commensurate with those in Falko’s prior funds.

- The forecast revenue is based on current contracted lease revenue and forecasted revenues for leased aircraft and asset management fees. Aircraft leasing revenue under the CPA and Fixed Margin revenue is expected to be US $114.7 million and $66.3 million, respectively in 2022.

- The forecast uses weighted average statutory tax rates for each of the individual entities based on the jurisdiction in which the entity is taxable. The forecast uses a weighted average income tax rate of 20.0% based on average statutory tax rates of 26.5%, 12.5% and 19.0% in Canada, Ireland and United Kingdom, respectively. The actual weighted average income tax rates may vary due to the actual income in each country and foreign exchange rates.

- The forecast assumes no disposals in 2022 of aircraft leased under the CPA or in the RAL segment.

- The forecast uses a foreign exchange rate of 1.28 a change from the initial forecasted rate of 1.25 to translate USD to CAD revenue and expenses.

Regional Aircraft Leasing

Following the onset of the COVID-19 pandemic, RAL received requests from many of its customers for some form of temporary rent relief, as they coped with an unprecedented reduction in demand for passenger air travel. Under rent relief arrangements, certain of which include lease term extensions, the repayment of the deferred amounts typically coincides with the lease term extensions. RAL collected approximately 88% of lease revenue billed in the second quarter of 2022. The gross lease receivable may decrease to approximately $119.0 million (US $92.3 million) (June 30, 2022 $122.0 million (US $94.6 million)) by the end of 2022 due to rent relief arrangements and repayment expectations.

RAL’s lease deferral receivable exposure is also partially mitigated by security packages held of approximately $23.4 million (US $18.2 million) (December 31, 2021 – $26.8 million (US $21.1 million)).

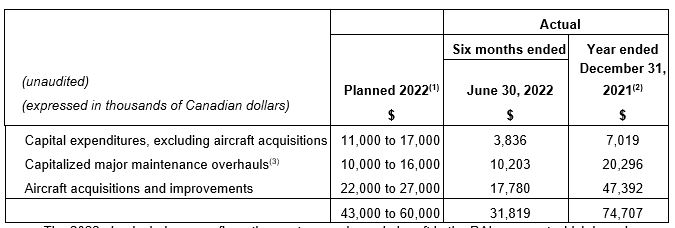

Capital Expenditures

Capital expenditures in 2022, including capitalized major maintenance overhauls but excluding expenditures for the acquisition of aircraft are expected to be between $21.0 million and $33.0 million. Aircraft acquisitions and improvements in 2022 are expected to be between $22.0 million and $27.0 million.(1)

Use of Defined Terms

Capitalized terms used but not defined in this news release have the meanings given to them in the MD&A which is available on Chorus’ website (www.chorusaviation.com) and under Chorus’ profile on SEDAR (www.sedar.com).

Investor Conference Call / Audio Webcast Chorus will hold an analyst call at 9:00 ET on August 5, 2022, to discuss the second quarter 2022 financial results. The call may be accessed by dialing 1-888-664-6392. The call will be simultaneously audio webcast via: https://app.webinar.net/oD09eP4ekY8

This press release was prepared and distributed by Chorus Aviation