Estimated reading time 27 minutes, 55 seconds.

Southwest Airlines Co. (NYSE: LUV) (the “Company”) today reported its third quarter 2021 financial results:

- Third quarter net income of $446 million, or $.73 per diluted share, driven by a $763 million offset of salaries, wages, and benefits expenses related to the receipt of Payroll Support Program (PSP) proceeds under the American Rescue Plan Act of 2021

- Excluding special items1, third quarter net loss of $135 million, or $.23 loss per diluted share

- Third quarter operating revenues of $4.7 billion, down 17.0 percent compared with third quarter 2019

- Ended third quarter with liquidity2 of $17.0 billion, well in excess of debt outstanding of $11.2 billion

Gary C. Kelly, Chairman of the Board and Chief Executive Officer, stated, “Third quarter 2021 was a challenge for us, operationally. Despite the deceleration of traffic in August and September due to surging COVID-19 cases, the third quarter 2021 demand and revenue performance was quite strong and a dramatic improvement from a year ago. That was a bright and encouraging sign of recovery, and I was especially pleased with July’s revenue and profit performance. We were aggressive with our capacity plans for third quarter 2021, coming close to pre-pandemic third quarter 2019 available seat miles. Our active (versus inactive) and available staffing fell below plan and, along with other factors, caused us to miss our operational on time performance targets, and that created additional cost headwinds. The net effect, including a revenue penalty of $300 million due to the COVID-19 surge, was a loss of $135 million, excluding special items.

“We have reined in our capacity plans to adjust to the current staffing environment, and our on time performance has improved, accordingly. We are aggressively hiring to a goal of approximately 5,000 new Employees by the end of this year, and we are currently more than halfway toward that goal. Our 2022 capacity planning reflects more conservative staffing assumptions, as well, all compared to historical norms. With respect to our fourth quarter 2021 revenue outlook, while there are lingering effects from the summer COVID-19 surge and recent operational challenges, we are encouraged with renewed momentum in leisure and business traffic, revenues, and bookings—especially over the holidays. Except for higher fuel prices, fourth quarter 2021’s overall results are trending better than third quarter 2021.

“I am very proud of our People. They worked especially hard in challenging circumstances. We made good progress in our pandemic recovery in third quarter 2021, and I expect more in fourth quarter. I’m very excited about the demand recovery and our prospects for 2022. Our Leadership has an excellent plan with a laser focus on execution. We are in a very strong financial position, and I thank all of our People for their resilience, their resolve, and their devotion to serving our valued Customers.”

Revenue Results and Outlook

The Company’s third quarter 2021 operating revenues increased 161.0 percent, year-over-year, to

$4.7 billion, but decreased 17.0 percent compared with third quarter 2019 due to the impact of the pandemic. Third quarter 2021 operating revenue per available seat mile (RASM, or unit revenues) was 12.07 cents, a decrease of 15.7 percent, compared with third quarter 2019, driven primarily by a passenger revenue yield decrease of 15.0 percent and a load factor decrease of 2.8 points.

Although less severe than prior waves of rising COVID-19 cases, the negative effects associated with the Delta variant are estimated to have impacted August and September 2021 operating revenues by approximately $100 million and $200 million, respectively. Despite the demand deceleration, third quarter 2021 operating revenues and revenue passengers reached 83 percent and 87 percent of 2019 levels, respectively, which is meaningful progress and a strong indication of the pent-up demand for air travel. Revenue and booking trends began to significantly improve in the second half of September 2021 as COVID-19 cases declined, which resulted in an improvement in the Company’s September and third quarter 2021 operating revenues as compared with the Company’s previous estimation. September 2021 managed business revenues declined 73 percent compared with September 2019.

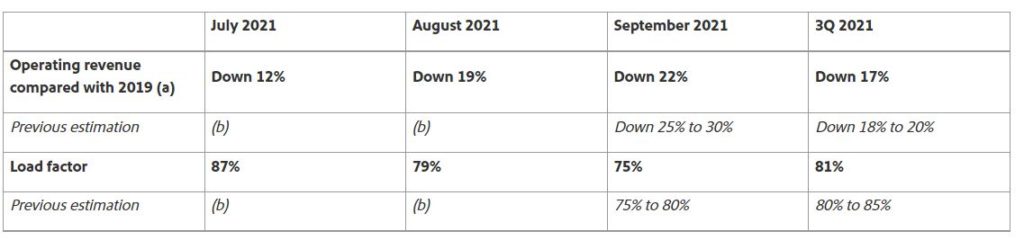

The following table presents selected revenue and load factor results for third quarter 2021:

(a) The Company believes that operating revenues compared with 2019 is a more relevant measure of performance than a year-over-year comparison due to the significant impacts in 2020 due to the pandemic.

(b) Remains unchanged from previously provided estimation.

The Company is encouraged by recent improvements in underlying revenue trends as COVID-19 cases have declined; however, the lingering effects from the deceleration in bookings in third quarter 2021 are estimated to negatively impact fourth quarter 2021 operating revenues by approximately $100 million. For October 2021, despite the improvement in revenue and booking trends experienced in the second half of September 2021 continuing, thus far, into this month, October operating revenues include two headwinds—an estimated $40 million negative impact due to the lingering effects of the Delta variant and an estimated $75 million negative impact as a result of flight cancellations from operational challenges experienced earlier this month and related Customer refunds and gestures of goodwill. Despite these headwinds, and based on current bookings, the Company’s guidance for October 2021 operating revenues remains unchanged, as the recent improvement in travel demand trends offsets the aforementioned headwinds. Business revenues continue to lag leisure revenue trends; however, the Company is encouraged by the recent improvement in business travel demand resulting in steady improvements in business bookings, thus far, in October 2021. Beyond October 2021, the current booking curve for the holidays is trending in line with 2019 levels.

The following table presents estimates of revenue and load factor for October and fourth quarter 2021:

(a) The Company believes that operating revenues compared with 2019 is a more relevant measure of performance than a year-over-year comparison due to the significant impacts in 2020 due to the pandemic.

(b) Remains unchanged from previously provided estimation.

(c) No previous estimation provided.

The Company went live with Sabre’s Global Distribution System (GDS) platform on July 26, 2021, achieving the Company’s goal of enabling industry-standard corporate bookings through multiple GDS platforms. In addition to Sabre, the Company is currently accepting corporate bookings through Amadeus’s GDS platform and Travelport’s multiple GDS platforms (Apollo, Worldspan, and Galileo). The Company’s enhancement of its GDS channel strategy is part of its larger “channel of choice” offering and complements its “direct connect” strategy, as well as its existing SWABIZ® direct travel management tool. The goal is to distribute Southwest’s everyday low fares to more business travelers through their preferred channel and grow the Company’s managed business revenues.

Cost Performance and Outlook

Third quarter 2021 operating expenses increased 23.2 percent, year-over-year, to $3.9 billion, but decreased 18.1 percent compared with third quarter 2019 primarily due to a $763 million offset of salaries, wages, and benefits expenses related to the receipt of PSP proceeds, which was recorded as a special item. Excluding special items, third quarter 2021 operating expenses increased 40.6 percent, year-over-year, to $4.7 billion. Third quarter 2021 operating expenses per available seat mile (CASM, or unit costs) decreased 16.8 percent, compared with third quarter 2019. Excluding special items, third quarter 2021 CASM was comparable with third quarter 2019.

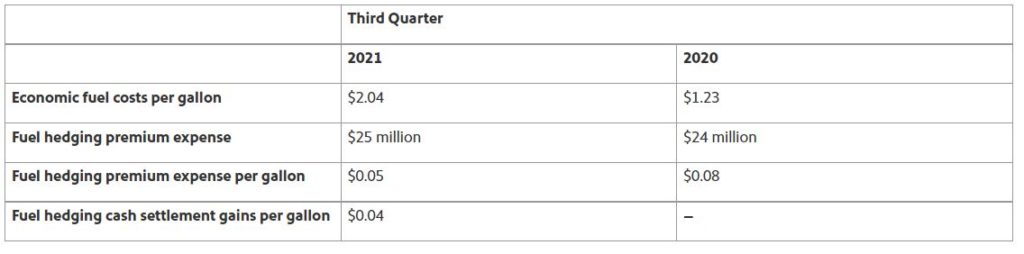

The following table presents economic fuel costs per gallon1, including the impact of fuel hedging premium expense and fuel derivative contracts, for third quarter 2021 and the corresponding prior year period:

The Company’s third quarter 2021 available seat miles (ASMs, or capacity) per gallon (fuel efficiency) declined 4.5 percent, year-over-year, due to the return to service of more of the Company’s least fuel-efficient aircraft, The Boeing Company (Boeing) 737-700 (-700). When compared with third quarter 2019, fuel efficiency improved 5.1 percent in third quarter 2021 due to the March 2021 return to service of the Company’s most fuel-efficient aircraft, the Boeing 737 MAX (MAX). The MAX remains critical to the Company’s efforts to modernize its fleet, reduce carbon emissions intensity, and achieve its goal of carbon neutrality by 2050. The Company expects fourth quarter 2021 fuel efficiency to be in line with third quarter 2021, on a nominal basis.

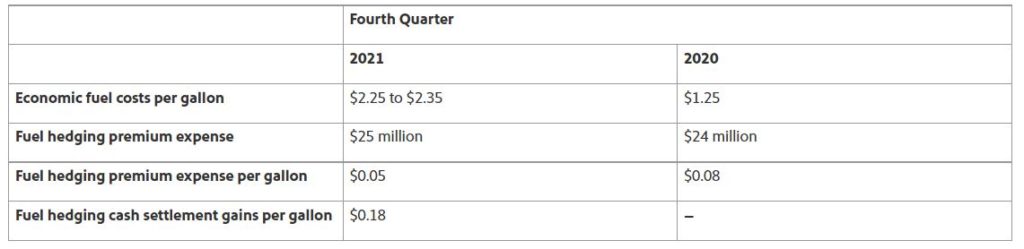

Based on the Company’s existing fuel derivative contracts and market prices as of October 14, 2021, the following table presents estimates of economic fuel costs per gallon3, including the estimated impact of fuel hedging premium expense and fuel derivative contracts, for fourth quarter 2021 and the corresponding prior year period:

As of October 14, 2021, the fair market value of the Company’s fuel derivative contracts for the remainder of 2021 was an asset of approximately $89 million, and the fair market value settling in 2022 and beyond was an asset of approximately $824 million. Additional information regarding the Company’s fuel derivative contracts is included in the accompanying tables.

Excluding fuel and oil expense, third quarter 2021 operating expenses increased 4.6 percent,

year-over-year, and decreased 20.8 percent, compared with third quarter 2019. The Company accrued

$77 million of profitsharing expense in third quarter 2021, for a total of $186 million year-to-date, compared with no profitsharing accrual in third quarter 2020. Excluding fuel and oil expense, special items, and profitsharing, third quarter 2021 operating expenses increased 22.9 percent, year-over-year, and increased 1.9 percent compared with third quarter 2019. Third quarter 2021 CASM, excluding fuel and oil expense, special items, and profitsharing, decreased 16.1 percent, year-over-year, driven primarily by an increase in capacity, and increased 3.5 percent compared with third quarter 2019, which was in line with the Company’s expectation. As expected, approximately four points of the unit cost increase, compared with third quarter 2019, was attributable to ramp up costs and premium pay offered to Operations Employees. The Company realized approximately $185 million of costs savings in third quarter 2021 from voluntary separation and extended leave programs and estimates annual 2021 cost savings from these programs to be in the range of $1.0 billion to $1.1 billion.

Based on current cost trends and reduced capacity plans, fourth quarter 2021 operating expenses, excluding fuel and oil expense, special items, and profitsharing, are expected to be comparable with fourth quarter 2019 levels, and increase in the range of 8 percent to 12 percent on a unit basis4 as compared with fourth quarter 2019. The Company is experiencing cost increases primarily due to inflation in labor rates and airport costs. Additionally, the Company currently expects four to five points of the unit cost increase in fourth quarter 2021 to be attributable to investments in the operation to bolster staffing, cost inflation related to lower productivity, and vaccination incentive pay. The Company recently launched a Vaccination Participation Pay Program to incentivize Employees with the equivalent of two days of pay intended to cover the time needed to become vaccinated.

Third quarter 2021 Other expenses increased $2 million, year-over-year, primarily due to a $12 million charge on the partial extinguishment of the Company’s convertible notes, partially offset by an improvement in other gains and losses driven by adjustments for fuel derivative contracts not designated as fuel hedges for accounting purposes. Both of these items are excluded from the Company’s non-GAAP results as special items. Additionally, interest expense in third quarter 2021 increased $4 million, year-over-year, driven by debt incurred since third quarter 2020.

The Company’s third quarter 2021 effective tax rate was 26 percent. The Company currently estimates its annual 2021 effective tax rate to be approximately 27 percent, compared with its previous guidance of approximately 26 percent.

Based on the current cost outlook, and despite the current momentum in revenue trends, the Company does not expect to be profitable in fourth quarter 2021.

Fleet and Capacity

The Company ended third quarter 2021 with 737 Boeing 737 aircraft, including 69 Boeing 737-8 (-8) aircraft. During third quarter 2021, the Company took delivery of one -8 aircraft and does not expect any additional deliveries in 2021. As of September 30, 2021, 24 -700 aircraft remained in temporary storage due to fourth quarter 2021 capacity remaining below fourth quarter 2019 levels. The Company still expects to return one leased -700 aircraft to the lessor in fourth quarter 2021, and recently made the decision to accelerate the retirement of eight -700 owned aircraft from 2022 into fourth quarter 2021, for a total of 18 retirements in 2021. The Company expects to end 2021 with 728 total aircraft.

During third quarter 2021, the Company exercised eight Boeing 737-7 (-7) options for delivery in 2022, and on October 1, 2021, the Company exercised another eight -7 options for delivery in 2023. Including the options exercised on October 1, 2021, the Company’s order book with Boeing contains 399 MAX firm orders (250 -7 and 149 -8) and 252 MAX options (-7 or -8) for years 2021 through 2031. The Company continues to expect that more than half of the MAX aircraft in its firm order book will replace a significant amount of its 461 -700 aircraft over the next 10 to 15 years to support the modernization of its fleet, a key component of its environmental sustainability efforts. Additional information regarding the Company’s aircraft delivery schedule is included in the accompanying tables.

The Company’s third quarter 2021 capacity increased 46.4 percent, year-over-year, due to increased flight activity driven primarily by increased leisure passenger traffic, but decreased 1.6 percent compared with third quarter 2019. The following table presents capacity results for third quarter 2021:

(a) No previous estimation provided.

The Company’s flight schedule is published for sale through April 24, 2022, and the Company currently expects first quarter 2022 capacity to decrease approximately 6 percent compared with first quarter 2019.

Liquidity and Capital Deployment

As of September 30, 2021, the Company had approximately $16.0 billion in cash and short-term investments, and a fully available revolving secured credit facility of $1.0 billion. The Company continues to have unencumbered assets with an estimated value of more than $11.0 billion, including aircraft value estimated in the range of $9.0 billion to $9.5 billion, and approximately $2.0 billion in non-aircraft assets such as spare engines, ground equipment, and real estate. In addition, the Company has significant value from its Rapid Rewards® loyalty program. As of October 20, 2021, the Company had cash and short-term investments of approximately $16.2 billion.

Net cash used in operations during third quarter 2021 was $575 million, driven primarily by the negative financial effects of the Delta variant on travel demand. Third quarter 2021 capital expenditures were $135 million. The Company continues to estimate its 2021 capital expenditures to be in the range of $500 million to $600 million, driven primarily by technology, facilities, and operational investments, as well as aircraft-related capital expenditures. Based on 72 MAX firm orders planned for 2022, the Company’s contractual aircraft capital expenditures for 20225 are now estimated to be approximately $1.7 billion, compared with its previous guidance of $1.6 billion. Further, the Company’s total contractual aircraft capital expenditures for all years 2022 through 2026, which represent 200 MAX firm orders (185 -7 and 15 -8), are estimated to be approximately $6.0 billion. Fleet and other capital investment plans are expected to continue to evolve as the Company manages through this pandemic recovery period, and the Company intends to evaluate the exercise of its remaining 42 MAX options for 2022 as decision deadlines occur.

As of September 30, 2021, the Company had current and non-current debt obligations that totaled $11.2 billion. The Company repaid approximately $188 million in debt and finance lease obligations during third quarter 2021, including the extinguishment of $80 million in principal of its convertible notes for a cash payment of $121 million. The Company is currently scheduled to repay approximately

$182 million in debt and finance lease obligations in fourth quarter 2021. Based on current debt outstanding and current market interest rates, the Company expects fourth quarter 2021 interest expense to be approximately $115 million. As of September 30, 2021, the Company was in a net cash position6 of $4.8 billion, and its adjusted debt7 to invested capital (leverage) was 56 percent. The Company remains the only U.S. airline with an investment-grade credit rating by all three rating agencies.

Awards and Recognitions

- Ranked #1 for Newsweek’s America’s Best Customer Service in the Low-Cost Airlines category

- Named a Best Employer for Women 2021 by Forbes

- Named a Best Place to Work for Disability Inclusion after achieving a top score on Disability:IN’s 2021 Disability Equality Index

- Ranked #1 in the Excellence in Reputation Management category for the 2021 Gartner Communications Award

Environmental, Social, and Governance (ESG)

- Established a plan of action to reduce Southwest’s carbon emissions intensity by at least 20 percent by 2030 and maintain carbon neutral growth every year through the end of the decade

- Partnering with ChoooseTM and Customers to offset Southwest’s carbon emissions by providing the first U.S.-based airline carbon offset offer with loyalty points and for every dollar contributed toward offsetting Southwest’s carbon emissions, Southwest will match the contribution8

- Published a Human Rights Policy which formalizes Southwest’s longstanding support of human rights principles

- Outlined the next steps in Southwest’s Continued Commitment to increase racial and gender diversity in Southwest Leadership

- Assisted with humanitarian efforts to relocate Afghanistan refugees, operating 93 domestic charter flights carrying more than 11,000 People across the United States

- Expanded citizenship reporting in the Southwest Airlines One Report to include the Sustainability Accounting Standards Board (SASB), United Nations Sustainable Development Goals (UNSDG), and Global Reporting Initiatives (GRI) Standards

Conference Call

The Company will discuss its third quarter 2021 results on a conference call at 12:30 p.m. Eastern Time today. To listen to a live broadcast of the conference call, please go to

http://www.southwestairlinesinvestorrelations.com.

1See Note Regarding Use of Non-GAAP Financial Measures for additional information on special items. In addition, information regarding special items and economic results is included in the accompanying table Reconciliation of Reported Amounts to Non-GAAP Items (also referred to as “excluding special items”).

2Includes approximately $16.0 billion in cash and short-term investments and a fully available secured revolving credit line of $1.0 billion.

3Based on the Company’s existing fuel derivative contracts and market prices as of October 14, 2021, fourth quarter 2021 economic fuel costs per gallon is estimated to be in the range of $2.25 to $2.35. Economic fuel cost projections do not reflect the potential impact of special items because the Company cannot reliably predict or estimate the hedge accounting impact associated with the volatility of the energy markets, the impact of COVID-19 cases on air travel demand, or the impact to its financial statements in future periods. Accordingly, the Company believes a reconciliation of non-GAAP financial measures to the equivalent GAAP financial measures for projected results is not meaningful or available without unreasonable effort. See Note Regarding Use of Non-GAAP Financial Measures.

4Projections do not reflect the potential impact of fuel and oil expense, special items, and profitsharing because the Company cannot reliably predict or estimate those items or expenses or their impact to its financial statements in future periods, especially considering the significant volatility of the fuel and oil expense line item. Accordingly, the Company believes a reconciliation of non-GAAP financial measures to the equivalent GAAP financial measures for these projected results is not meaningful or available without unreasonable effort.

5Net of progress payments made on undelivered MAX aircraft.

6Net cash position is calculated as the sum of cash and cash equivalents and short-term investments, less the sum of short-term and long-term debt.

7Adjusted debt is calculated as short-term and long-term debt, including the net present value of aircraft rentals related to operating leases.

8Taxes and fees will not be matched by Southwest or earn points. Southwest’s contribution may be used to purchase offsets for Southwest from any carbon offset project of Southwest’s choice. Rapid Rewards® Members can earn 10 Rapid Rewards bonus points per dollar contributed towards the purchase of offsets for Southwest up to a maximum of 500 Rapid Rewards bonus points per month. Points will only be awarded to the Rapid Rewards Member’s Rapid Rewards account number entered at the time of the carbon offset transaction. Terms and conditions apply.

This press release was prepared and distributed by Southwest Airlines